Last week in a nutshell

📢 11 expected IPOs in 2024; signs of an IPO bubble in India.

💸 Adani overtakes Ambani as India’s richest.

📈 Last month, total new Demat account openings touched a new high of 42 lakh.

📝 Gujarat govt signs deal worth $86 billion ahead of investment summit.

🔻 VC fundraising in the US hits a 6-year low.

The big story: The 2024 IPO frenzy

In 2023, India saw a rush in the stock market with new companies going public almost every day.

This attracted a lot of people trying to make quick money. While SMEs were only looking to raise ₹4,500 crores, investor bids went up to ₹4,00,000 crores. This shows how people are over-eager to put their money into IPOs.

IPOs like Ola Electric, targeting $700-800 million, and FirstCry, aiming for $500-600 million, are eagerly awaited. Other upcoming IPOs include Awfis, Unicommerce, Aakash, PhonePe, Oyo, PharmEasy, Swiggy, PayU India, and MobiKwik. Investors should do their own research before investing in these IPOs. Don’t fall for the social media hype!

In our proprietary analysis, we have examined 12-month, 24-month, and 36-month forward return expectations. We believe that the next one to three years will be challenging for the small-cap index, and we do not anticipate any significant, sustainable returns during this period. Our preference lies with large caps, a sector that has been largely overlooked. You can view the full report here.

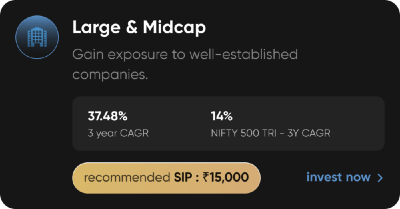

As small caps begin to underperform, we expect a substantial flow of money back into large caps. To capitalize on this opportunity we recommend our "Large & Midcap" portfolio 👇