India's affluent class is growing, with a threefold increase in those earning over 5 lakh rupees in 8 years. Although poverty persists, the rise in high-income earners mirrors China's trajectory, suggesting increased spending potential as income levels rise.

View the other parts of this report here,

- Debt Markets are expected to do well: The Repo Rate Story

- Large & Mid Caps are undervalued: The Overheated small cap zone

Download the full report here 🔗

Table Of Content

- Rising Affluent Class in India

- Per Capita Income Comparison: India and China

- Future Projections: High-Income Earners in India

- Luxury Car Sales and Spending Power

- The Great Indian Middle-Class: Our Recommended Offering

Quick Summary

India witnesses a surge in affluence with doubled IT returns and a threefold increase in high-income earners. Projections indicate transformative shifts and luxury markets stand to benefit.

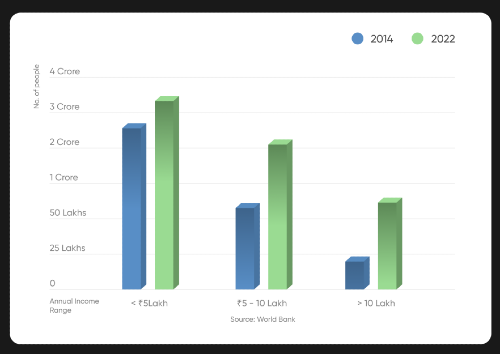

Rising Affluent Class in India

India's economic landscape is evolving, exemplified by a twofold increase in filed IT returns and a threefold rise in individuals earning over 5 lakh rupees in the last 8 years. This shift, though coexisting with widespread poverty, indicates a growing number of people ascending into the affluent high-income category. Factors such as urbanization, technological advancements, and evolving consumer aspirations contribute to this transformative trend.

Per Capita Income Comparison: India and China

India's current per capita income aligns with China's economic status 15-16 years ago, laying the foundation for potential growth. A comparative analysis of China's trajectory in luxury car sales reveals insights into India's evolving consumer behavior, hinting at increased demand for high-quality goods as income levels rise.

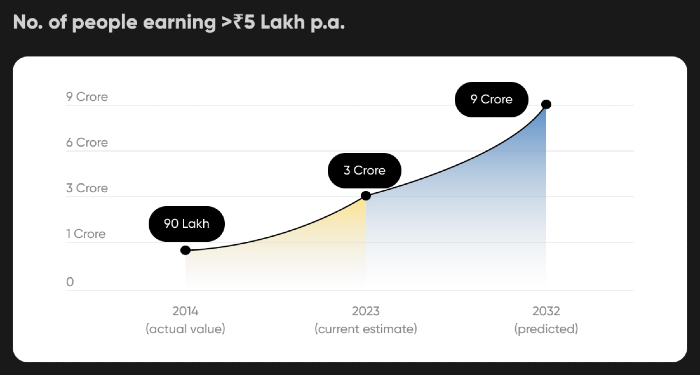

Future Projections: High-Income Earners in India

Projections for high-income earners in India showcase a significant rise in individuals earning between 5 and 10 lakhs, and over 10 lakhs. This anticipated surge signals a transformative shift in spending power, with implications for various sectors such as real estate, luxury goods, and premium services. The trajectory suggests a shift towards a more affluent and consumer-driven society.

Luxury Car Sales and Spending Power

Despite a decade-long plateau in luxury car sales in India, reminiscent of China's historical context, current indicators suggest an imminent surge. Analyzing China's experience, this trend implies that India is on the brink of a spending power surge. The potential rise in income levels is expected to drive increased consumption of luxury goods, presenting opportunities for industries catering to high-end markets.

About Stack Wealth

We help you access exclusive wealth creation opportunities by helping you invest in premium multi-asset portfolios managed by real experts.

Learn more

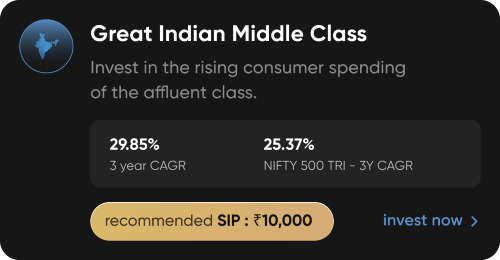

Great Indian Middle-Class: Our Recommended Offering

The ascension of India's affluent class carries profound implications for companies operating in consumer-led sectors. Industries such as real estate, premium retail, and luxury goods stand to benefit as higher disposable incomes translate into increased consumer spending. Companies like Titan, HDFC, and Avenue Supermarts exemplify this trend, experiencing growth in tandem with rising affluence.

Want to know more?

Talk to our wealth team.

They will be happy to help you manage your investments.

Talk to an expertTo capitalize on this opportunity, experts at Stack Wealth have curated the "Great Indian Middle Class" mutual fund portfolio. This portfolio strategically selects mutual funds poised to leverage the evolving dynamics of India's economic landscape. Seize the potential for wealth creation by investing in mutual funds aligned with the burgeoning affluent class.