From all the companies listed on the BSE, nearly 2,000+ saw a downward trend, while 447 went up and 76 remained the same. Experts suggest the shedding has only begun however, with investors losing about 5 Lakh Crore of value within just the first 15 minutes of trading on today, 6th May.

While many investors are dismayed by the shift in the market tides, companies have also borne the brunt of the recent macroeconomic decisions and geopolitical climate that has led to the current state of events.

Let’s explore the reasons behind the recent market turbulence to better understand how to tackle it:

1. RBI revising repo rate - The central banks' decision to increase the policy rate and cash reserve ratio has definitively had a big impact on the market faltering. This seems to be in connection with a global trend where UK, followed by US, both increased their respective policy rates significantly this quarter.

While indices like Sensex and Nifty50 lost more than 2% due to this, on a whole their growth was still outperformed against other counterparts in Asia.

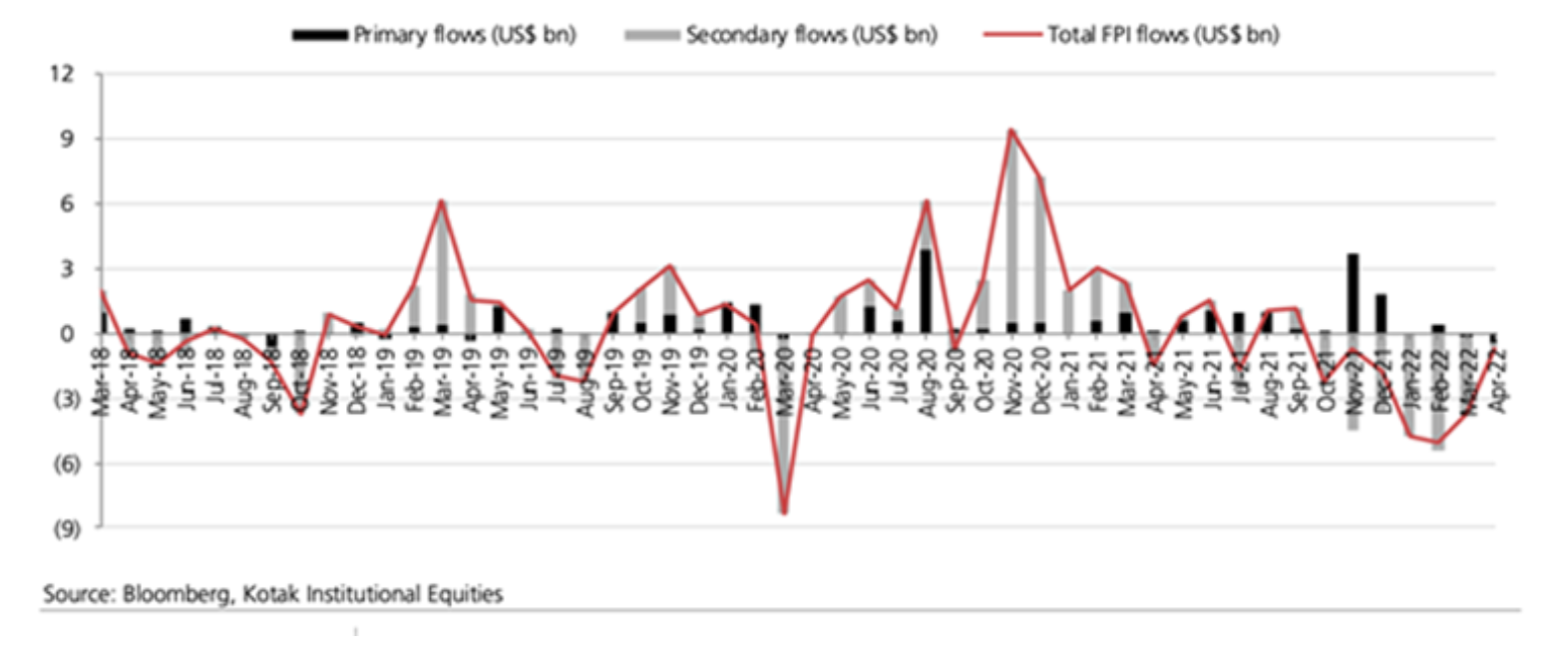

2. Foreign portfolio investors retracting - Another reason we may be witnessing market turbulence is on account of an 8-month-long retraction trend from foreign investors from the Indian markets. Foreign investors seemed to have lost confidence in the Indian economy, now becoming the largest net-sellers consistently since March.

Experts suggest that this can be on account of the dollar rising steadily against the Indian rupee. Emerging markets equities like India, have been said to have an inverse relationship to the dollar and may have led institutional investors on a selling spree.

3. US market weakness - Another reason why FPIs might be pulling out of the country could be in anticipation of a large shed in US equities. The country’s economic readings show a sharp rise in unemployment, which could lead to further constrictions in the US labor market, in general.

4. Continued oil price hikes - With the tumultuous months brought on by the Russia-Ukraine crisis, oil prices kept shooting up for the third week in a row. While globally, experts suggest a point of short supply would reach soon, OPEC has only marginally increased output citing Russia and China’s new lockdowns as barriers.

Plan of action - What should you do next?

How we as retail investors can leverage the market downturn moving forward strongly depends on our individual investing strategy.

STEP 1- Time to go back to the drawing board ✍️

Market falls are a good respite to stop and analyse your overall portfolio and see if there are any shortfalls in your current diversification tactics. Often, we feel the pinch of a market drop more severely because we fail to cushion and safeguard our portfolio with less riskier asset classes.

This is the best time to do that and invest more securely across different investing vehicles so that in the future it helps mitigate losses.

STEP 2- Go back to the basics 🏢

The truth of the matter is that only companies with strong fundamentals can safely sail across the turbulent tides of a volatile market. The current market downturn is a good opportunity to invest more consistently in such companies as opposed to penny stocks.

STEP 3- Hit pause on the goals ⏸

If you are looking to save for a specific short-term goal, right now may not be the best time to do so. We suggest waiting it out until the markets stabilise rather than rishi no to invest, just to buy the dip.

STEP 4- Long way to go 🛣

For investors looking to invest for the long term, the best advice we can give is to stay steady and not panic. To offset any short term losses, investors can look towards diversifying across different debt instruments and safer assets. You may use this as an opportunity to buy quality large-cap stocks at a discounted price as well.

With this strategy, your portfolio would be set to balance any short-term fluctuations and ride out the tide, while making enough room to stay focussed on your long-term goals.