Last week in a nutshell

Apple is Buffett’s best investment, with the highest stock return of all time

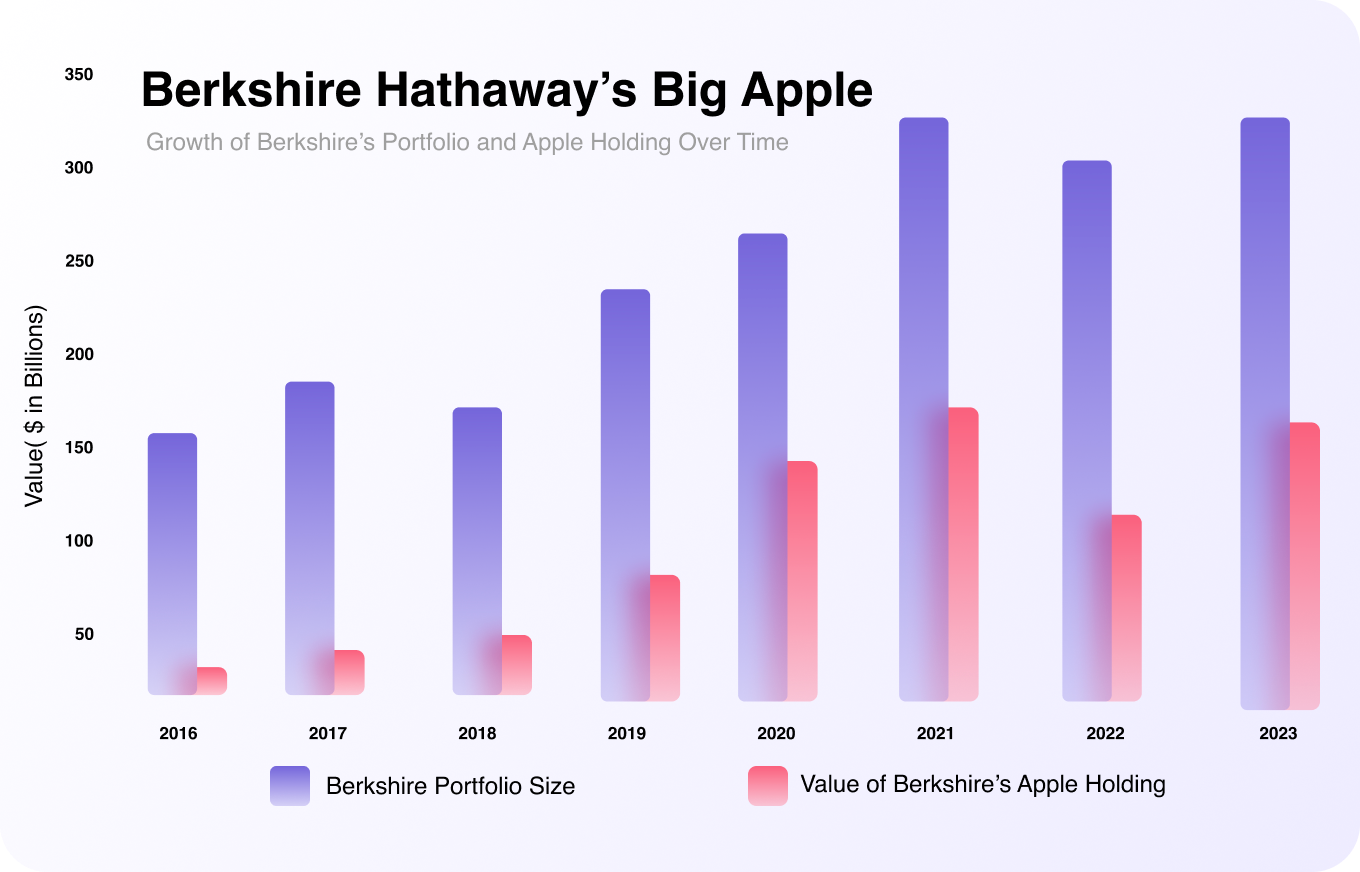

In 2016, Buffett made perhaps the most surprising bet of his career. That year, Berkshire Hathaway, the company he runs, began buying up shares of Apple—the exact kind of stock Buffett and his longtime partner, Charlie Munger, had long avoided. Keep scrolling for the full story.

Adani Group faces Sebi scrutiny; show-cause notices issued to 6 firms

Six Adani Group firms have received show-cause notices for alleged breaches in related party transactions and non-compliance with listing regulations. A show cause notice details an offence and asks the recipient to explain why disciplinary action should not be taken.

ICICI market cap tops Rs 8 trillion, bank storms into the top five

Shares of ICICI Bank surged over 5% on Monday, sending its market capitalization past the 8-trillion mark and into the league of the top five companies by market value. The top 5 company market caps in order are Reliance, TCS, HDFC, ICICI and Airtel

Keep scrolling to read the big story 👇

Buffett’s Apple bet—the good, bad & ugly

Apple is Warren Buffett’s greatest investment. It has also become one of his riskiest.

In 2016, Buffett made perhaps the most surprising bet of his career. That year, Berkshire Hathaway, the company he runs, began buying up shares of Apple—the exact kind of stock Buffett and his longtime partner, Charlie Munger, had long avoided.

But was "Apple" Buffett & Munger's usual stock choice?

There were other reasons for Buffett and Munger to steer clear. Apple doesn’t own extensive real estate or other physical assets that can provide investors with a certain safety cushion. And Buffett and Munger had long avoided technology stocks, saying they didn’t fully understand the fast-changing industry.

In the end, it was worth it.

By the end of the third quarter of 2018, Berkshire’s Apple stake represented about a quarter of its entire investment portfolio. Berkshire is sitting on about $120 billion in paper gains, likely the most money ever made by an investor or a firm from a single stock.

Cut to today...

On Thursday, Apple said revenue declined for the fifth time in the past six quarters, and it authorized $110 billion in stock buybacks, sending shares higher in after-hours trading.

Apple shares remain expensive compared with the overall market despite this year’s drop, trading at about 25 times its expected earnings over the next 12 months, adding to the position’s risk.

There is a compelling reason for Berkshire to hold on to its Apple shares, and it might be the key one Buffett isn’t selling: It likely would be hard for Berkshire to find better uses for all the cash that a sale would produce.