Table Of Content

-

The Problem with Traditional SIPs

The Problem with Traditional SIPs

-

The Solution: Dynamic SIPs

The Solution: Dynamic SIPs

-

The Importance of Emotional Intelligence

The Importance of Emotional Intelligence

-

The Cyclical Nature of Stock Market Returns

The Cyclical Nature of Stock Market Returns

Quick Summary

Dynamic SIPs, which adjust investment amounts based on market conditions and financial goals, can generate higher returns than traditional SIPs. Emotional intelligence is important in investing, and investors should rebalance their portfolios based on market movements. The stock market has a cyclical nature, and investors should consider stepping up their commitments during periods of low returns.

Introduction

Investing in SIPs has long been a popular topic among investors and for good reason. SIPs are a great way to save and use the power of compounding to build wealth and retire early. However, simply investing in SIPs and forgetting about them may not be enough to generate high returns. Wealth managers promise market-beating returns through active management, but their high fees are typically only affordable to the wealthy. About 32 Portfolio Management Services schemes gave one-year returns in double digits in 2022 ranging between 10% and 35%.

The Problem with Traditional SIPs

Retail investors are left wondering why they're only being told to invest in index funds, while wealth managers use advanced investment tools and provide access to exclusive investment opportunities to help their richie rich clientele compound their wealth faster. The problem with traditional SIPs is that they are static, meaning the same amount is invested at regular intervals, regardless of market conditions or the investor's financial goals.

Reality check: A plain vanilla SIP is honestly a way to help generate savings that just about keep up with inflation. They may not necessarily help create generational wealth! (Well unless you keep going at it for a 30-year period by when your kid’s kid will have a shot at enjoying that pile of money that you spent saving up)

The Mutual Fund industry aims to convince regular investors that they do not have the knowledge to understand the stock market, and therefore, investors should let them manage their investments instead. These funds operate by collecting money from investors and investing it in handpicked stocks to provide good returns, charging a fixed fee of typically 1-2% annually.

However, this fee remains unchanged regardless of whether the fund manager delivers high returns or not. As a result, investors are paying a fee for underperformance. Some suggest a solution to this problem could be to change the incentives by getting rid of the fixed fee and introducing a performance fee. However, this approach also has its drawbacks, including low hurdles, increased risk-taking by fund managers, and the absence of concrete data to indicate that performance fee-based mutual funds deliver superior returns.

The Solution: Dynamic SIPs

Really? Simple SIPs aren’t the road to creating true wealth? Yes. If you truly want to create wealth internalise two things:

- Compounding is back-ended

- Returns are cyclical, viz., a period of fantastically high returns ultimately lead to a period of depressingly low or negative returns which in turn beget a period of high returns. And the Wheel keeps turning.

Enter Dynamic SIPs: Dynamic SIPs basically involve adjusting the SIP amount based on prevailing market conditions while balancing the investor's financial objectives. This allows for more active management and potentially higher returns.

Want to know more? Talk to our advisory team. They will be happy to help you invest in your future!

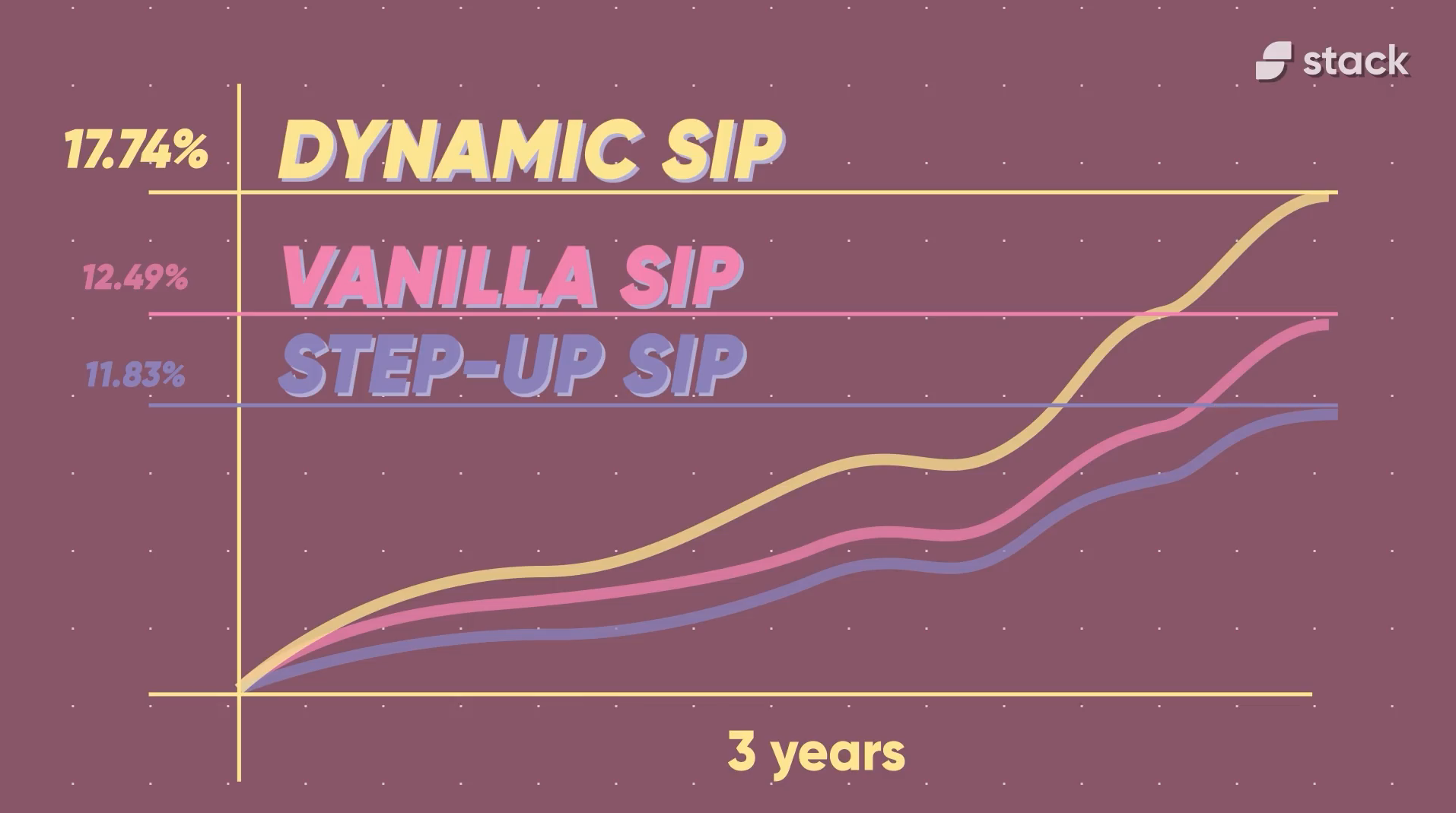

Talk to an expertData crunched by the investment team at Stack shows that Dynamic SIPs have generated materially higher returns compared to Plain Vanilla and even Step Up SIPs over various time periods. For instance, over a 15-year period, a Dynamic SIP generated returns of 12.40%, while a Plain Vanilla SIP generated 11.76% returns.

The Importance of Emotional Intelligence

Investing requires emotional intelligence (EQ), which many people lack. They tend to invest the most at market peaks only to eventually bail out at market bottoms. This lack of EQ is also the reason why the average lifespan of SIPs is low. Did you know that only 1 in 10 investors in India today run an SIP beyond 5 Years? In fact the average lifespan for an SIP is just around 2 years.

Investors should focus more on rebalancing their portfolios dispassionately once every couple of years inverse to market movements, by observing market movements from a distance, while switching out of underperforming mutual funds as and when deemed necessary by their financial advisor.

The reality is that your Fund manager (in the case of Index investing the fund managers are the predefined algorithms being run by Exchanges) will determine the outcome of your returns only to a small extent. What you do as an investor will ultimately determine the true outcome of your end financial goal!

The Cyclical Nature of Stock Market Returns

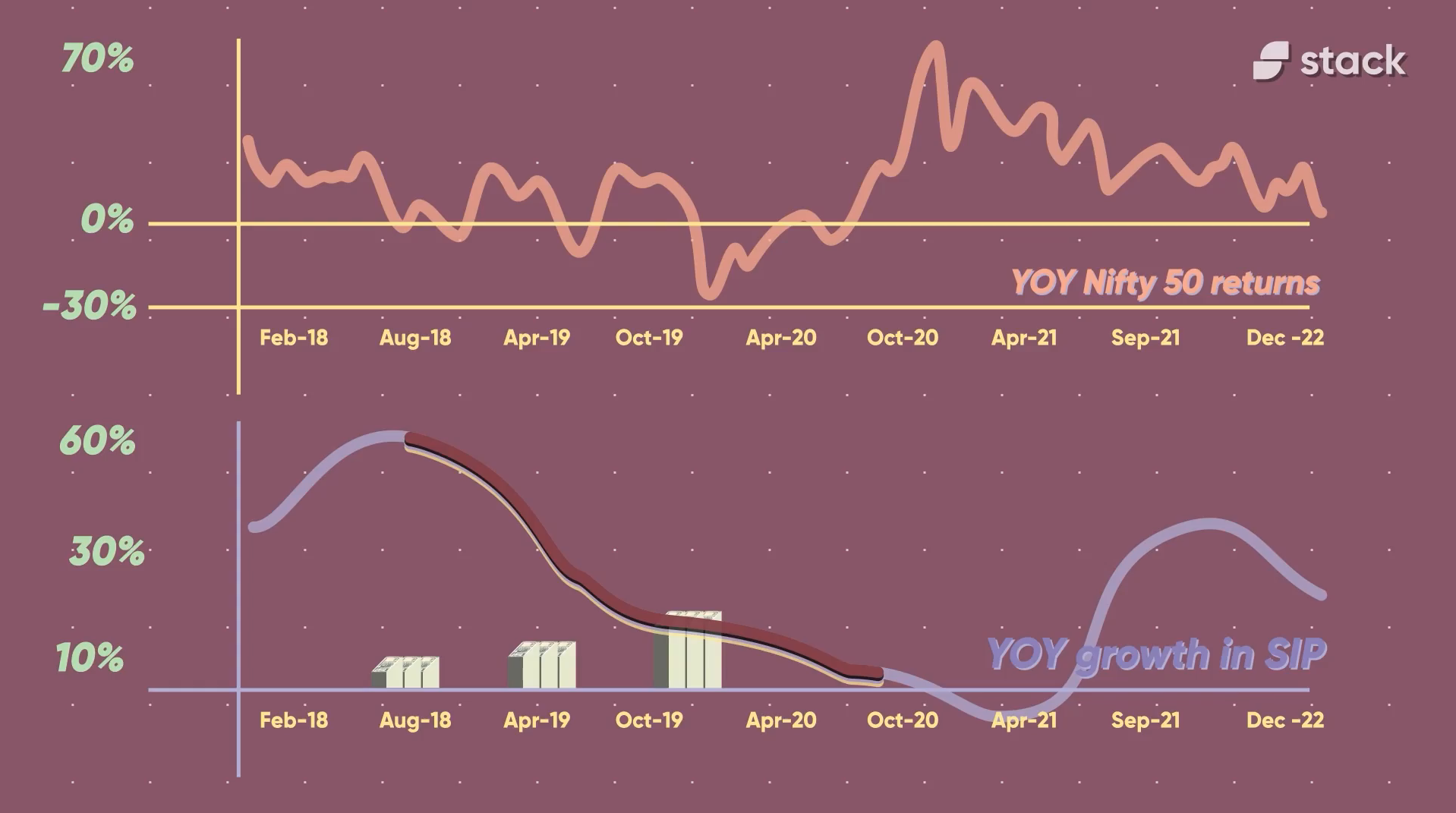

Investing in the stock market can be a rollercoaster ride, with ups and downs that can be difficult to predict. However, a careful analysis of the data can reveal patterns and trends that can be helpful in making informed investment decisions. One such pattern is the cyclical nature of stock market returns, as illustrated by two charts displayed below.

The second chart shows how SIP flows, with a roughly 4-6 month lag, tend to stagnate or even decline when returns start to drop. This is a natural reaction, as investors become hesitant to continue investing in a market that appears to be performing poorly (refer to the 1-year returns in the first chart).

However, this is precisely the point where future potential returns become very promising. In the example provided, growth in SIPs between April and October 2020 went negative, just as the market was on the verge of a major upswing. Had they continued to invest, the end result going into 2021-22 would have been very different!

The same charts clearly show how investors have only recently begun to step up their SIP commitments, starting from around September-October-2021. This is interesting because the equity markets effectively topped out in October 2021, yet these investors were only looking at the last 1-3 year high CAGRs and stepping up their investments. It is likely that once these investors finish their 24-month cycle of SIPs by August-September of 2023, they will become disillusioned with the lack of returns and may start to withdraw from the market altogether.

However, this is precisely the time when savvy investors should consider stepping up their commitments to equities. As the market becomes flooded with disillusioned investors, prices may drop, creating a buying opportunity for those who are willing to stay the course and invest for the long term.

About Stack

We help you invest like the top 1%. Stack lets you access exclusive wealth creation opportunities by helping you invest in premium multi-asset portfolios managed by real experts.

Learn moreIt is important to remember that investing in the stock market requires patience, discipline, and a long-term perspective. While short-term fluctuations can be nerve-wracking, it is the long-term trends that ultimately determine the success or failure of an investment strategy. By paying close attention to the cyclical nature of stock market flows and making informed decisions based on this data, investors can increase their chances of achieving their financial goals over the long term by becoming more data-dependent with respect to their decision-making rather than getting swayed by a convenient rosy narrative.

Conclusion

Dynamic SIPs offer a way for retail investors to achieve higher returns through active management, similar to what professional wealth managers offer to their high-net-worth clients. However, investors must show reasonable financial maturity and actively manage their portfolios to maximize their portfolio returns. While past performance does not guarantee future results, historical data clearly shows that Dynamic SIPs have generated materially higher returns than traditional SIPs across multiple time frames.

Stack helps you invest with Dynamic SIPs. Our experts notify you when you should boost and when you should reduce your SIP investments based on market conditions. With our expertise and your disciplined investing, there will be nothing stopping you from entering the top 1% of India.