Quick Summary

Equity and debt mutual funds have different asset allocation, with equity performing better in terms of annualised returns. Rebalancing your portfolio is essential for successful investing, helping to manage risk and maximize returns.

How are Equity & Debt Different?

The primary difference between equity and debt funds is risk.

Equity has a higher risk profile compared to debt. Investors must understand the relationship between risk and return; the higher the risk, the higher the return. If you take more risk, you should have a longer investment tenure.

Equity funds invest primarily in shares of companies. The primary objective of investing in stocks is capital appreciation and the possibility of income dividends.

Debt funds invest primarily in debt and money market instruments. The primary objective of investing in debt or money market instruments is to get income in the form of interest payments.

The other significant difference between debt mutual funds and equity mutual funds is that many types of debt funds allow investment for one day (like overnight funds) to many years (kike medium to long-term funds or Gilt funds).

When you buy and sell equities is very important as the stock market is very dynamic and may be very volatile at times. This is relatively less important when it comes to debt funds.

Starting 1st April 2023, the debt funds will no longer receive indexation benefit and deemed to be short-term capital gain. Therefore, the gains from debt funds will now be added to your taxable income and taxed at the slab rate. Earlier, the long-term capital gains from debt funds were taxed at 20% with indexation benefit.

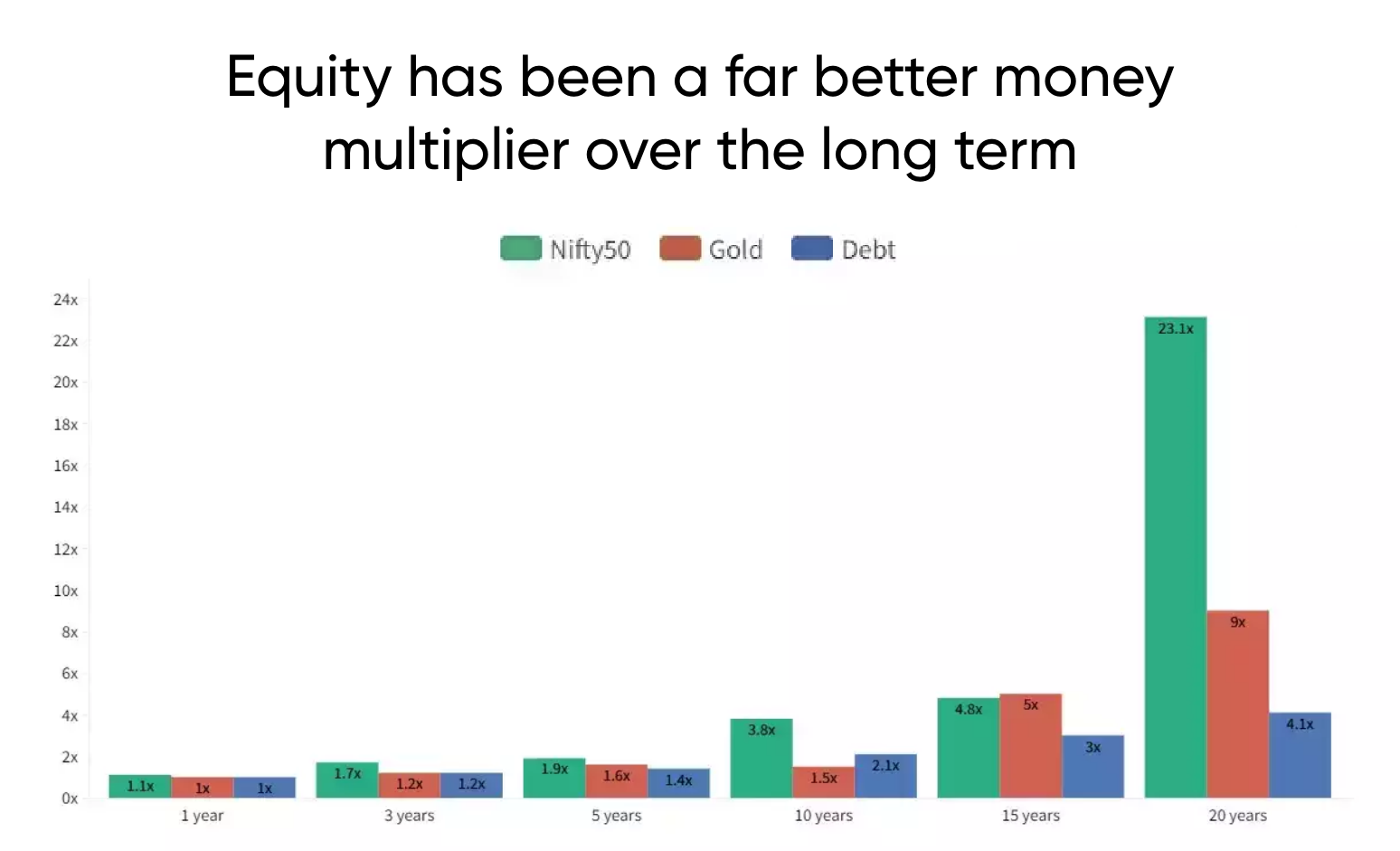

Equity & Debt Returns in the last 20 years

When it comes to equity vs. debt, equity tends to perform better in terms of annualised returns.

Investing in the Indian stock market seems to be a viable option for long-term investments, with the Nifty50 outperforming Debt and Gold over multiple time horizons, ranging from 3 to 20-year periods (Refer table below).

The major difference in performance between equity & debt is only seen over a 20-year investment horizon. There is little to no difference when the investment horizon is less than 5 years, based on overall historical performance.

The right mix of equity and debt in your portfolio

The common rule of asset-allocation by age is % of the equity in your portfolio = 100 - your age. e.g: if your age is 40

% of equity = 100 - 40 = 60%

Since life expectancy is growing, changing that rule to 110 minus your age or 120 minus your age may be more appropriate.

As your risk tolerance decreases with your age, it makes sense to start allocating lesser equity in your portfolio.

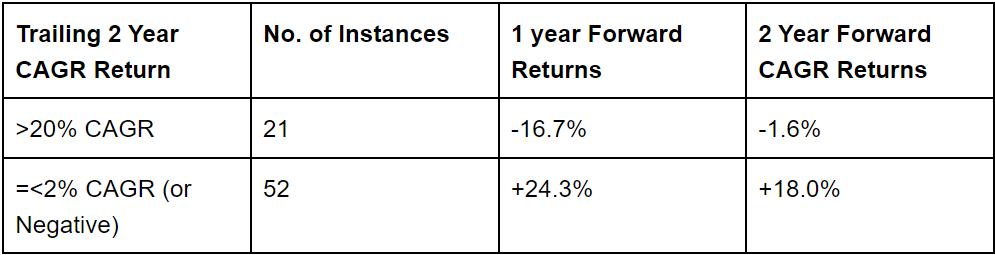

As a thumb rule - "Periods of low trailing returns ultimately lead to periods of high returns and vice versa as market returns are always going to mean revert to their long-term averages. Your portfolio returns are ultimately determined by two factors: Where did you enter into a particular asset class in its individual cycle and for how long did you hold it"

Based on the fact that market returns are cyclical, you should invest more when the market returns are low, and invest less when market returns are high. This means that when you see equities show a strong period of underperformance, you think counterintuitively and must allocate more of your portfolio to equity and vice versa.

The below table highlights what happened to forward returns whenever the previous 2 years trailing returns have been abnormally high or extremely low since January 2008 (15 Years Data):

So yes, your asset-allocation definitely needs to change with market cycles lest you fall prey to any error of commission!

If you have more money invested in stocks than in bonds, you might want to reduce the amount of money you have in stocks to reduce your risk level.

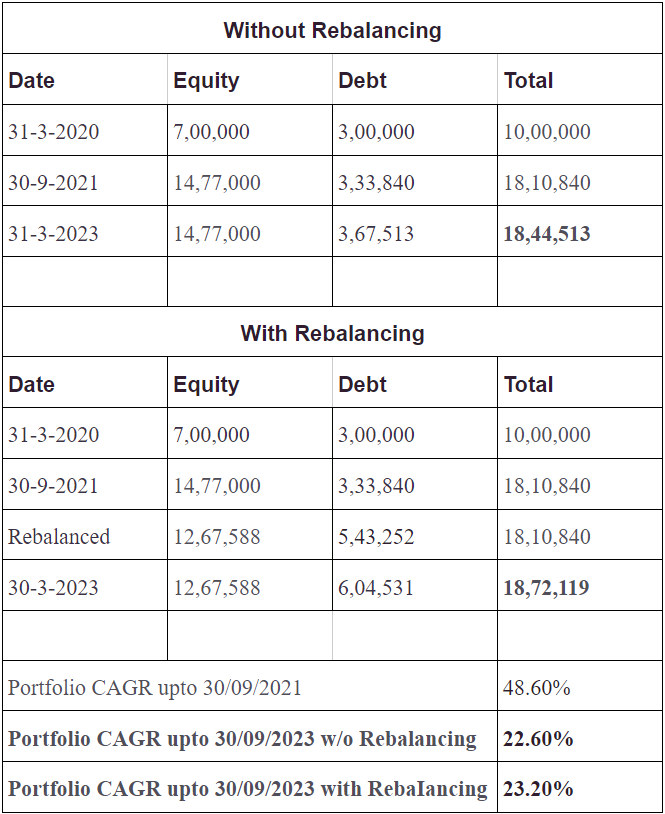

For example, if you started with Rs. 10 lakhs in March 2020 and decided to put 70% in Nifty Index ETF and 30% in bonds, then by October 2021 your overall portfolio would have grown to Rs. 18 Lakhs with your equity exposure hitting 82%. Now, this is where smart portfolio rebalancing comes into play.

Want to know more? Talk to our advisory team. They will be happy to help you invest in your future!

Talk to an expertSimply rejigging allocations periodically (say once a year) and bringing your portfolio back to its original weight will lead to you adding substantially higher alpha as compared with a plain buy-and-hold strategy. How so?

If you had held on to the portfolio in the above example, this would have been your outcome:

In the above example, it's important to note that equity markets have remained essentially FLAT since the past 18 months and yet a smart rebalancing exercise would have helped you to gain 60bps in terms of portfolio alpha.

To clarify, portfolio alpha refers to the excess returns generated by a portfolio compared to its benchmark, and a 60 basis point increase would mean that the portfolio outperformed its benchmark by 0.6%.

Conclusion

Rebalancing your portfolio is an essential aspect of successful investing. The purpose of rebalancing is to maintain the desired asset-allocation by periodically buying or selling assets to ensure that they remain in proportion to the overall portfolio.

It can also help to maximize returns by taking advantage of market conditions that may favour certain asset classes at different times.

About Stack

We help you invest like the top 1%. Stack lets you access exclusive wealth creation opportunities by helping you invest in premium multi-asset portfolios managed by real experts.

Learn moreIf you feel too overwhelmed to rebalance your portfolio - Stack is the right solution for you. Our experts track the markets and curate a portfolio for you to invest in, with the right mix of equity, debt and gold. You get to choose to increase your investments when the market dips and vice versa to boost your potential returns in the future.