Your ESOPs are taxed twice, in 2 stages.

And that's why most employees don't exercise the ESOPs when they leave the organization.

Employee Stock Option Plans (ESOPs) are all the rage these days with most start-ups deploying them as a tool to acquire and retain quality employees. ESOPs provide employees with a stake in the company's success and can be a valuable source of long-term wealth accumulation.

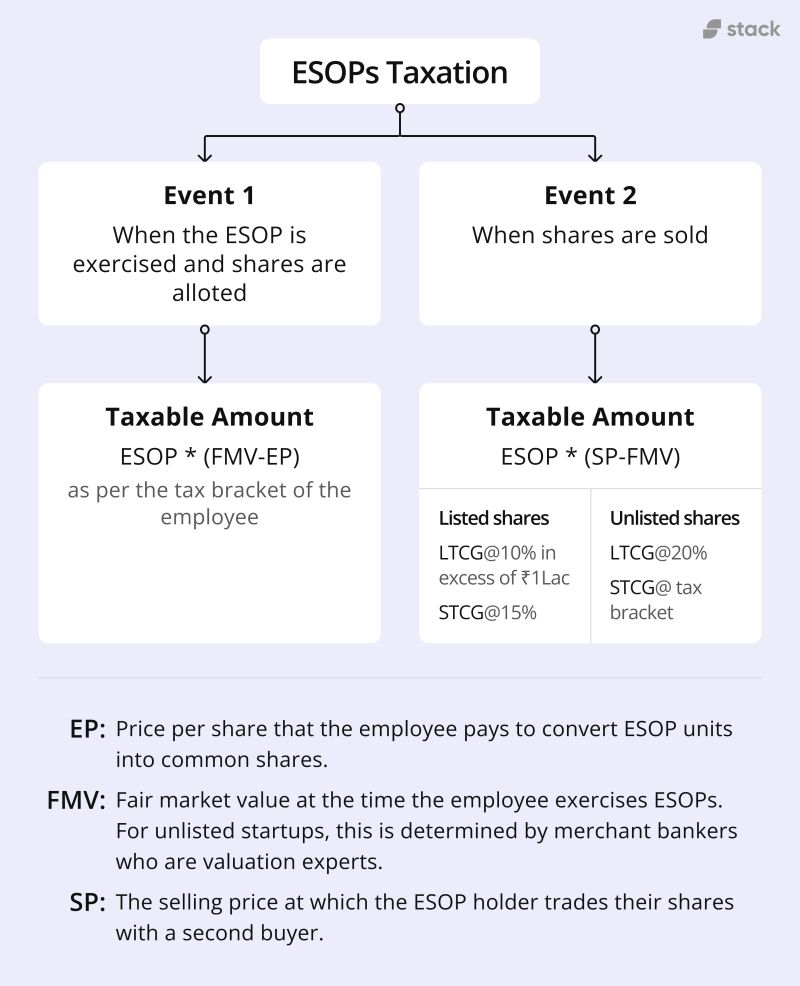

However, one area of concern for many employees who receive ESOPs is taxation. The tax implications get triggered at two stages –

1. At the time of exercise of options and

2. At the time of sale of shares

Event 1 -

When an employee exercises options, the difference between the FMV and the EP of the shares is taxed as a salary perquisite according to the employee’s prevailing income tax rate.

let's take an example - Let’s say total vested ESOP units = 2500 EP (exercise price) = ₹10 FMV = ₹20 Taxable amount = 2500*(20-10) = ₹25,000

Event 2 -

When the employee actually sells the share either in the public markets or to another buyer within the private ecosystem, the difference between this selling price (SP) and the FMV at the time the ESOP was exercised is taxed as a capital gain.

Unlisted shares should be held for more than 2 years to qualify as a long-term capital asset. In case of listed shares, if the shares are held for more than 12 months, the same would qualify as long-term capital assets.

In our example - SP (selling price) = ₹40 Taxable amount = units * (SP-FMV) = 2500*(40-20) = ₹50,000

To minimize the tax burden, individuals with ESOP units from unlisted companies are advised to delay exercising their options (event 1) unless there is a ready market to swiftly sell the shares for a profit (event 2).

In other words, it's smart to wait until -

1. There's possibility of an IPO

2. acquisition of the company

3. Buyback program from the company

Otherwise, you may be liable for taxes based on hypothetical gains during the first taxable event, even when the actual profits, occurring at a later taxable event, are still long while away.