Understand the problem before you try to solve it - What is inflation?

In finance, inflation is described as a gradual decline in the purchasing power of money. As the general price of goods and services increases in the economy, each unit of money will buy fewer items.

According to the RBI, inflation is now projected at 6.7 per cent in 2022-23. Your money loses a lot of value if not invested properly.

So the goal of tackling inflation is to protect your money from losing value by investing it in assets that in fact benefit from inflation. These are some assets that perform well during inflation -

- Short-term debt funds

- Equity Mutual Funds

- US Equities as per our new fund addition

- Gold & other commodities

Let’s dive deep into these three asset categories, and seeing how they perform during inflation.

Short-Term Debt Funds

Short-term funds are debt funds that lend to companies for a period of 1 to 3 years. These funds mostly take exposure only in quality companies that have a proven record of repaying their loans on time as well as have sufficient cash flows from their business operations to justify the borrowing.

For conservative investors or for those who have a shorter time frame, investing in short-term debt funds like liquid funds and money market funds is preferred. They tend to gain value when RBI starts hiking rates.

Equity Mutual Funds

Investing in long-term equity mutual funds is one of the best ways to battle inflation. Choose investments that have the potential to generate a significantly greater rate of return. Three reasons explain why they may be your best chance against inflation.

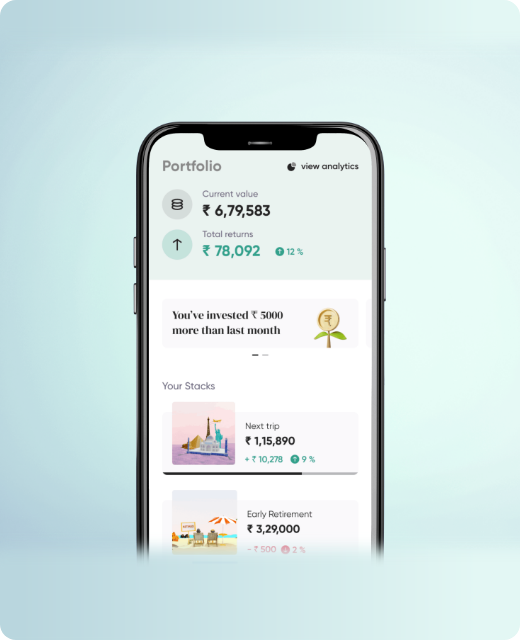

Stack curates and continuously rebalances your investments in the right equity mutual funds to capture the growth in the market while beating inflation rates by a huge margin. Investing in these portfolios through SIPs can beat inflation with ‘rupee cost averaging’ while generating higher returns of up to 17%.

US Equities

The best way to battle the depreciation of the Indian Rupee is to capture the growth of US equities that are not linked with the Indian economy.

Benefits of this diversification include -

- Exposure to the US equity market with nearly 100% of the entire investable US equity market.

- Exposure to US equities with a low correlation with Indian equities.

- Investing through US equity funds or funds of funds can reduce the risk further, as well as the fees charged on investing overseas

We have added Navi US Total Stock Market Fund of Fund as part of the portfolio that will act as a potential hedge against the depreciation of INR vs USD. Start investing in Stack to capture the growth of US equities.

Gold & Other Commodities

Gold is a hedge against inflation. Gold can provide better returns although it may not consistently beat inflation but merely track the inflation rate. Their prices tend to flatten during calm periods and become volatile during periods of uncertainty for reasons such as inflation or war.

It is a safe long-term investment option. Stack portfolios give the right amount of weightage to Gold assets, ensuring your money is loss-proof even during unstable market conditions. Prices of consumer goods increase during inflationary periods, due to which commodities tend to perform significantly better.

Automate Your Returns & Beat Inflation

As the RBI is projecting a 6.8% inflation rate by the year 2023, the only way you’re money will not lose its value is by investing it. Your financial goals become more distant due to inflation, requiring you to save even more than originally planned.

One of the few investment avenues that have the capacity to beat inflation comprehensively, in the long run, is equity invested through SIPs.

With the help of Stack, you can start by investing as little as ₹1000 every month to prepare yourself for inflation. Choosing to invest in long-term equity mutual funds is the only way to beat all kinds of market volatility in the long run and ensure that your wealth grows regardless.