What is Stack Flash?

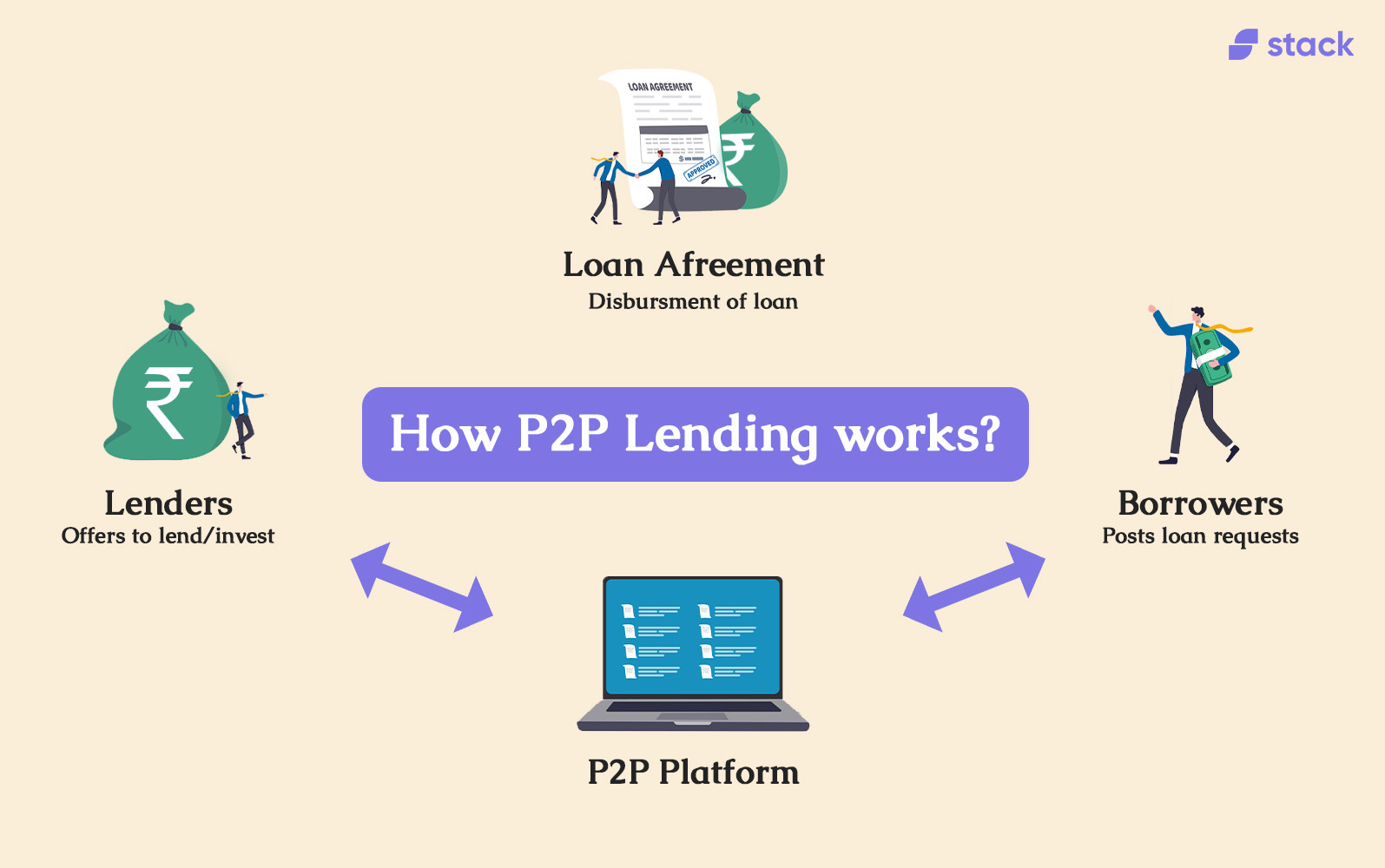

Stack Flash is a P2P investment that directly connects borrowers with good credit history with people who are willing to generate returns in form of interest when this money is paid back after being lent.

How would you explain a "peer-to-peer" investment to a five-year-old? It's a way for people to borrow money without going to a bank. When you make a peer-to-peer investment, you are helping someone else get the money they need, and you can earn more money for yourself by getting interest on the loan.

The whole process is overlooked by RBI. Strong credit assessments are conducted to ensure the risk of this investment is as low as possible. RBI-registered NBFC-P2P comes under RBI's purview of regulatory oversight. Getting the Certificate of Registration (CoR) from RBI further reinforces the brand Lendbox's trust amongst its borrowers and lenders.

Stack Flash is 100% safe. We follow a robust credit assessment policy to bring only the most creditworthy borrowers to the platform. We categorize borrowers by risk and allocate funds in a manner that reduces the risk of capital erosion for our investors.

Even in the rare case of a default, the principal amount of investment would be given back to the investors. And finally, there are zero transaction charges or any kind of fees when you invest or withdraw your funds in Stack Flash.

How do I earn returns every day with Stack Flash?

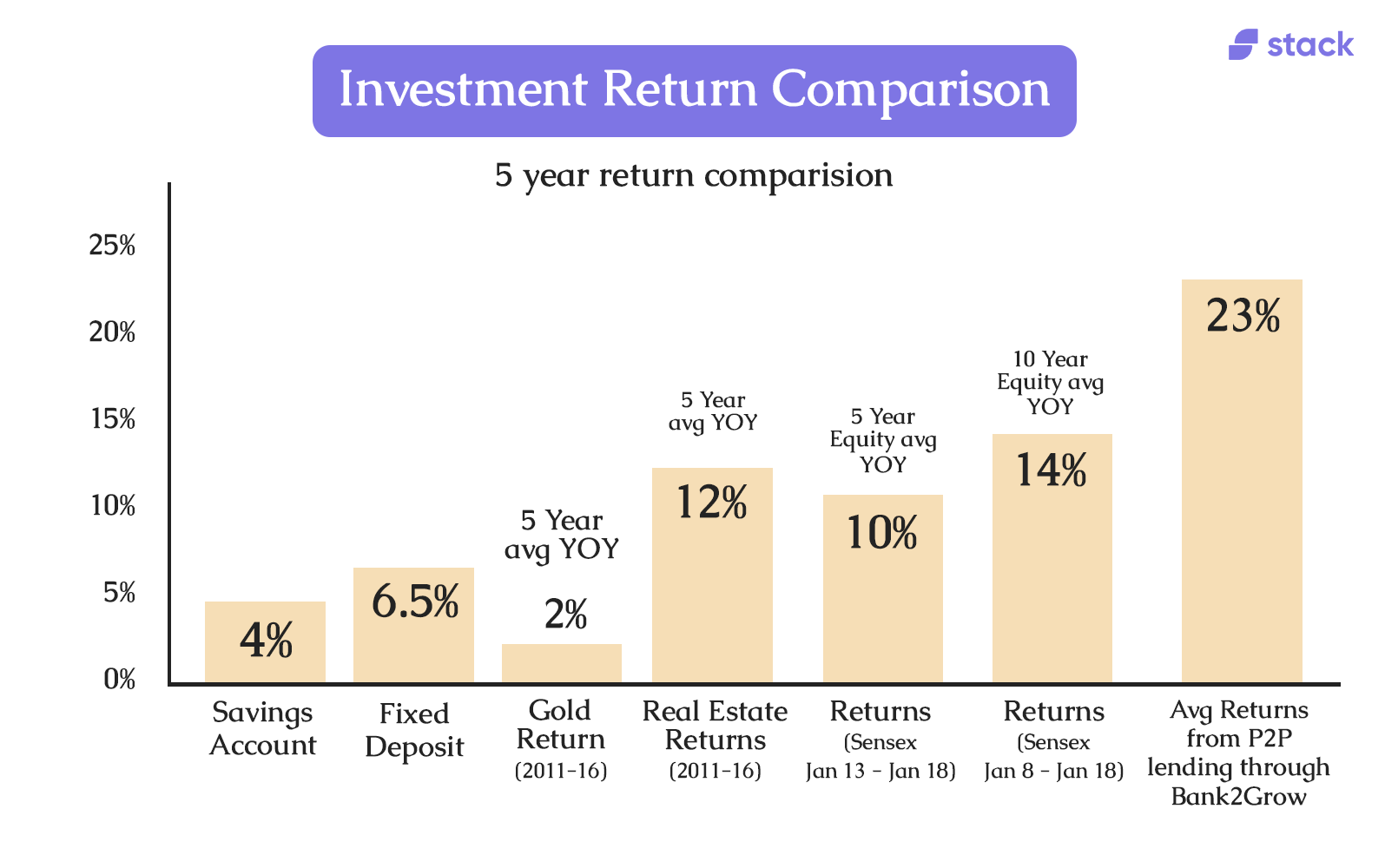

Stack Flash gives you up to 11% returns p.a., with no lock-in option and returns that are better than an FD with low risk. You earn daily & monthly interest with the Flexi & Fixed schemes respectively.

- The Fixed Scheme gives you up to 11% returns with a 1 year lock-in period and interest that can be credited to your account or reinvested every month.

- The Flexi Scheme gives you 9.5% returns with no lock-in period and the interest can be credited to your account daily. You can withdraw your investment anytime with the Flexi scheme.

How is Stack Flash different from Stack Prime?

Returns from P2P lending are dependent on the portfolio built by a lender and not on the stock market.

Unlike other market-linked investments such as mutual funds and systematic investment plans where the returns depend on the performance of the stock market, P2P lending returns are determined at the time of lending to a borrower and therefore P2P investments DO NOT depend on the stock market.

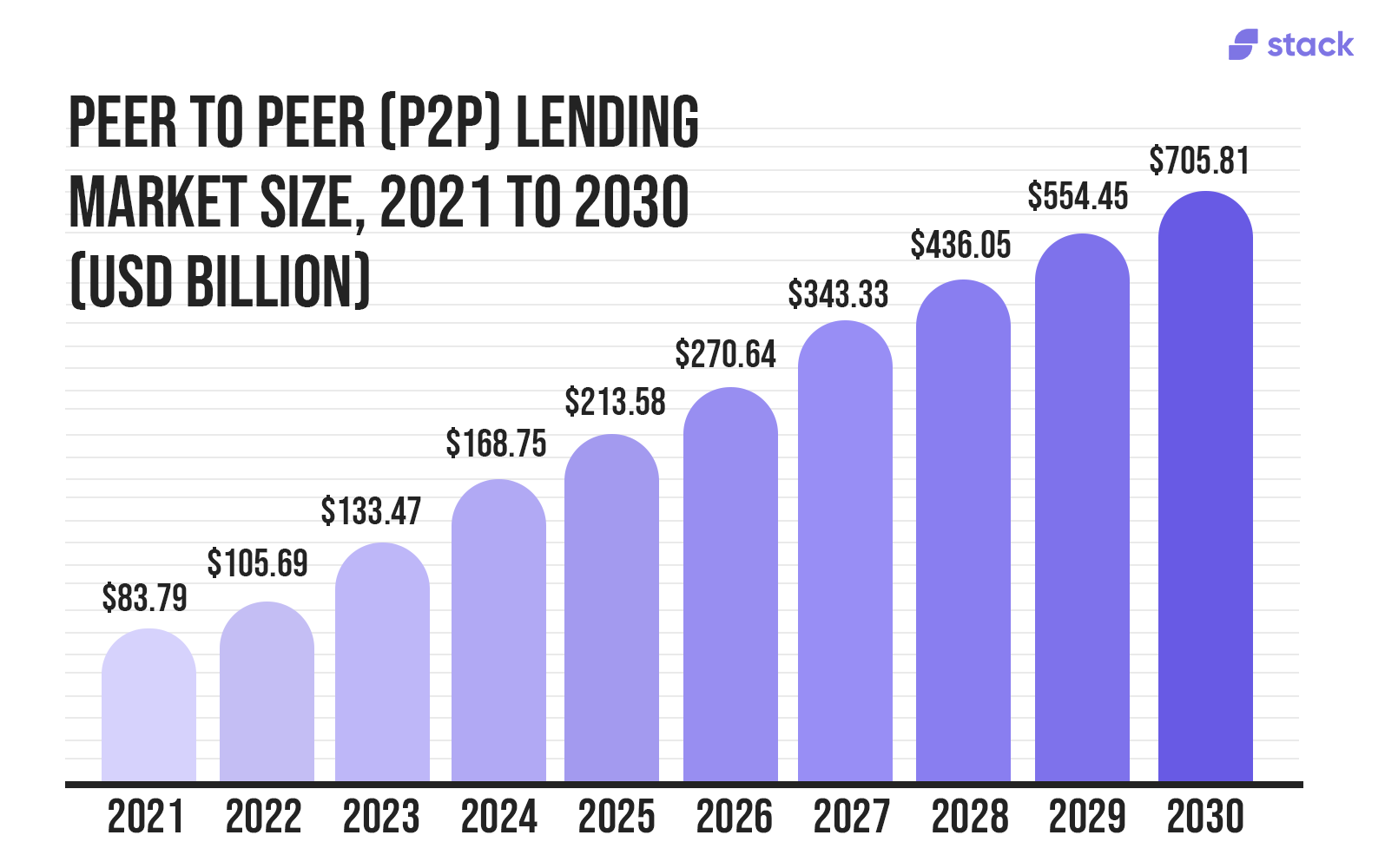

Peer-to-peer (P2P) lending can offer other advantages over other types of investments.

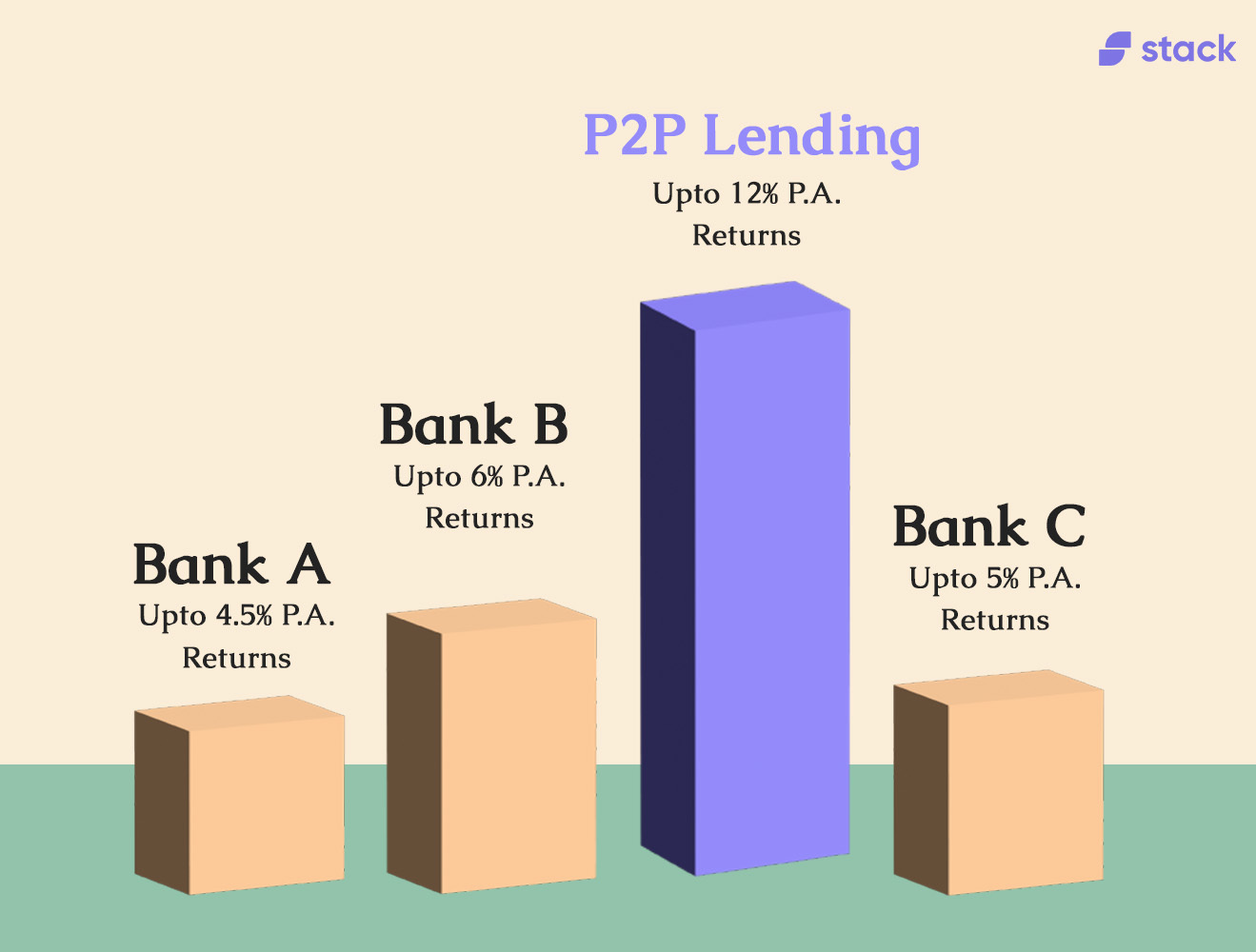

- Higher potential returns: This is because the interest rates on P2P loans are often higher than the rates offered by banks and because P2P investors can typically choose the interest rate they are willing to accept.

- Flexibility: Investors can tailor their investments to their own risk tolerance and financial goals.

- Convenience: With P2P lending platforms, investors can typically open an account and start lending money with just a few clicks, and they can manage their investments online or through a mobile app.

- Diversification: P2P lending can be a useful way to diversify a portfolio. By lending money to a variety of borrowers, investors can reduce the overall risk of their investments and potentially increase their returns.

- Passive Investment: Active investments like stocks require constant monitoring and a lot of time and effort. P2P lending is a passive investment that enables you to earn predictable returns. Dynamic investments like stocks and crypto require time and effort to avoid losses.

- Zero Transaction Fees: This investment has zero transaction fees which is common in other forms of investments like stocks.

- Low risk, stable returns: As these investments don't follow the stock market performance they tend to generate stable returns and are only affected by the creditworthiness of the borrower. With Stack Flash, a thorough and strict assessment of creditworthiness is conducted to ensure this.

What are the tax implications of Stack Flash?

The interest amount earned from P2P lending is classified as “Income from Other Sources”. It is added to the lender's income and taxed as per the tax bracket lender falls in. So if someone is in the 30% tax bracket, he will pay 30% tax on the interest earned.

How do you invest in Stack Flash on the app?

Assuming you have created an account on Stack and completed your KYC, the process to invest in Stack Flash is simple. Once you open the Stack App, on the home screen you will be able to navigate to the "Flash" menu. Once you enter the Stack Flash section all you have to do is

- Choose the Fixed or Flexi Scheme (Note: Fixed has a 1-year lock-in period)

- Enter the amount you would like to invest

- If you have chosen the "Fixed Scheme" you will be given the option to reinvest your returns at the end of every month. You can choose this to increase your principal amount to boost your overall returns.

- Confirm your payment.

- Once you confirm your payment, you will receive in-app & e-mail notifications confirming the status of your order.

- Once the order is complete (Usually within 2-3 business days) your investment will be confirmed.

- If you have invested in the Flash Flexi scheme, returns will be credited to your account every day. If you have invested in the Fixed Scheme, returns will be credited to your account every month (if you have not chosen to reinvest, which we would recommend for higher returns.

- If you have invested in the Flash Flexi scheme, you can withdraw your invested amount anytime. If you have invested in the Fixed Scheme, you can only withdraw your amount after one year.

Start earning returns every day. Invest like the top 1% with 👉 Stack Flash.