With Tata Technologies' recent Initial Public Offering (IPO), the technology world is aflutter. As the doors open on this eagerly awaited event, tech enthusiasts and investors alike are invited to witness the rise of a revolutionary force that has the power to change entire industries and push the envelope of innovation.

What is Tata Tech?

A leader in engineering and product development solutions, Tata Technologies is a division of Tata Motors. With an extensive history spreading over more than 40 years in engineering and technological solutions, they provide cutting-edge services in a number of industries, including consumer electronics, industrial machinery, automotive, and aerospace.

Tata Technologies stands out for its unwavering dedication to innovation. The organisation has led the way in advancing technological advancement, from utilising AI and machine learning to supporting digital transformation and environmental projects.

Financial Situation of Tata Tech

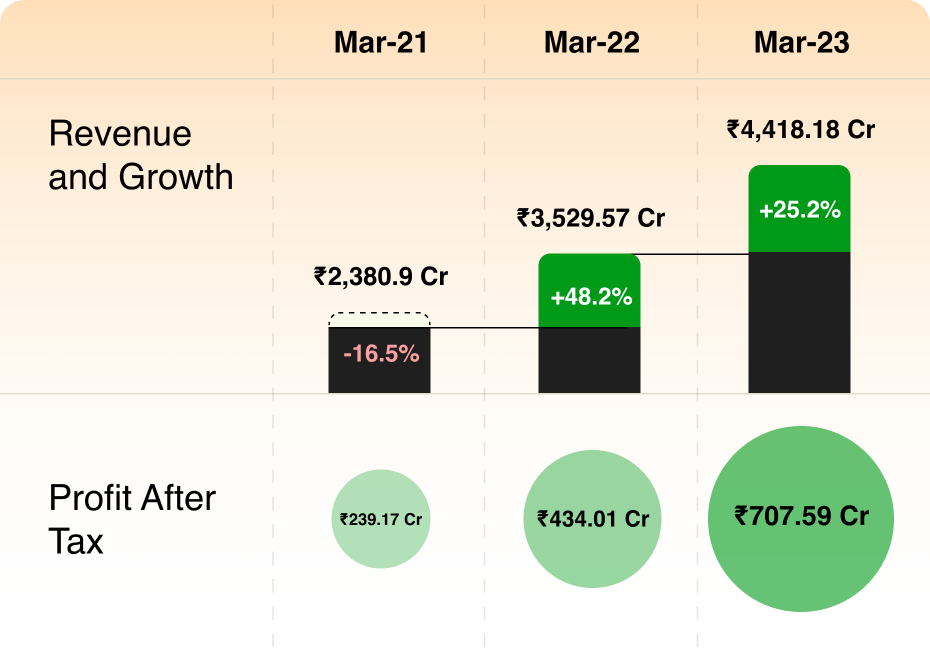

Robust profitability, steady expansion, and responsible financial management define Tata Tech's financial base. With a history of turning a profit, in the fiscal year that concluded on March 31, 2023, it showed a net profit margin of 14.2%. The company's ability to obtain high-value contracts, effectively control costs, and maintain efficient operations are the main drivers of its robust profitability.

The consistent growth in Tata Tech's revenue over the years can be attributed to the growing need for its engineering services expertise. The company's revenue for the fiscal year that concluded on March 31, 2023, was ₹4,414 crore, indicating a 16% increase from the previous year. The company's focus on creating novel solutions, its forays into new markets, and its solid clientele across the globe are the main drivers of this growth.

Tata Tech keeps its debt to a reasonable level and keeps a sound balance sheet. With a debt-to-equity ratio of 0.23, the business's debt is adequately covered by its equity. Tata Tech has the financial flexibility to invest in expansion prospects and withstand any downturns in the economy thanks to its strong financial position.

Tata Tech follows good financial management practices:

- The organisation has a strong framework for risk management in place to recognize, evaluate, and reduce possible risks.

- It upholds a methodical approach to capital allocation, guaranteeing that investments correspond with the strategic goals of the organisation.

Tata Tech IPO News Release

Tata Technologies' initial public offering (IPO) signalled the resilience of India's corporate sector and the allure of its burgeoning technology landscape, signalling hope in the midst of market volatility and a global economic slowdown.

When the IPO went live on November 22, 2023, it was greeted with an incredible amount of enthusiasm. This overwhelming achievement demonstrates the market's faith in Tata Tech's capacity for expansion and its aptitude for navigating the rapidly changing global engineering services industry.

In November 22–24, the first initial public offering (IPO) of the Tata Group in over 19 years was subscribed 69.4 times, with investors purchasing 312.65 crore equity shares against the offer size of 4.5 crore shares. In three days, they placed bids totaling Rs 1.56 lakh crore for shares.

High net worth individuals and qualified institutional buyers were among them, showing aggressiveness by purchasing 203.41 and 62.11 times their allotted quota, respectively, while the portions reserved for retail investors, Tata Technologies employees, and Tata Motors shareholders were subscribed 16.50, 3.7, and 29.2 times, among others.

Through a public offering, the international engineering services company raised Rs 3,042.51 crore at the upper price range of Rs 500 per share.

Parties involved in the IPO are:

- The promoter Tata Motors

- Investors Alpha TC Holdings

- Tata Capital Growth Fund I

A Quick Analysis of a Visionary Future

The IPO of Tata Technologies represents a vision that goes beyond profit margins, even in addition to the financial implications. In the future, technology will be used to advance humanity rather than just for its own sake, and this represents a commitment to that future.

The 69.4-times oversubscription of Tata Tech's IPO was indicative of the company's great success. The market's strong demand is a reflection of its faith in Tata Tech's potential for growth and its aptitude for navigating the fast-paced global engineering services industry.

The success of the IPO not only indicates the market's confidence in Tata Technologies, but it also shows how resilient India's corporate sector is in the face of a challenging global economy. It is evidence of the company's standing as a major force in the engineering services sector and its capacity to handle market turbulence while drawing sizable attention and funding from investors.

The business is well-positioned to grow further and is probably going to stay a significant player in the world market for engineering services.

Conclusion

The IPO of Tata Technologies is an invitation to join a revolution rather than merely another financial achievement. With India's economy growing and its technological capabilities increasing, Tata Tech is well-positioned to be a major force in determining the direction of engineering and innovation in the future. It marks the start of a brand-new era that will be characterised by creativity, sustainability, and endless possibilities. Investors who rush to take advantage of this chance are not just funding a business; they are funding the possibility of a game-changing future.