Introduction

Tax harvesting is a powerful strategy that can help you minimise your tax liability and maximise your investment returns. In this blog post, we will explore how to implement tax harvesting using an example to provide a clearer understanding of its benefits.

Example Scenario

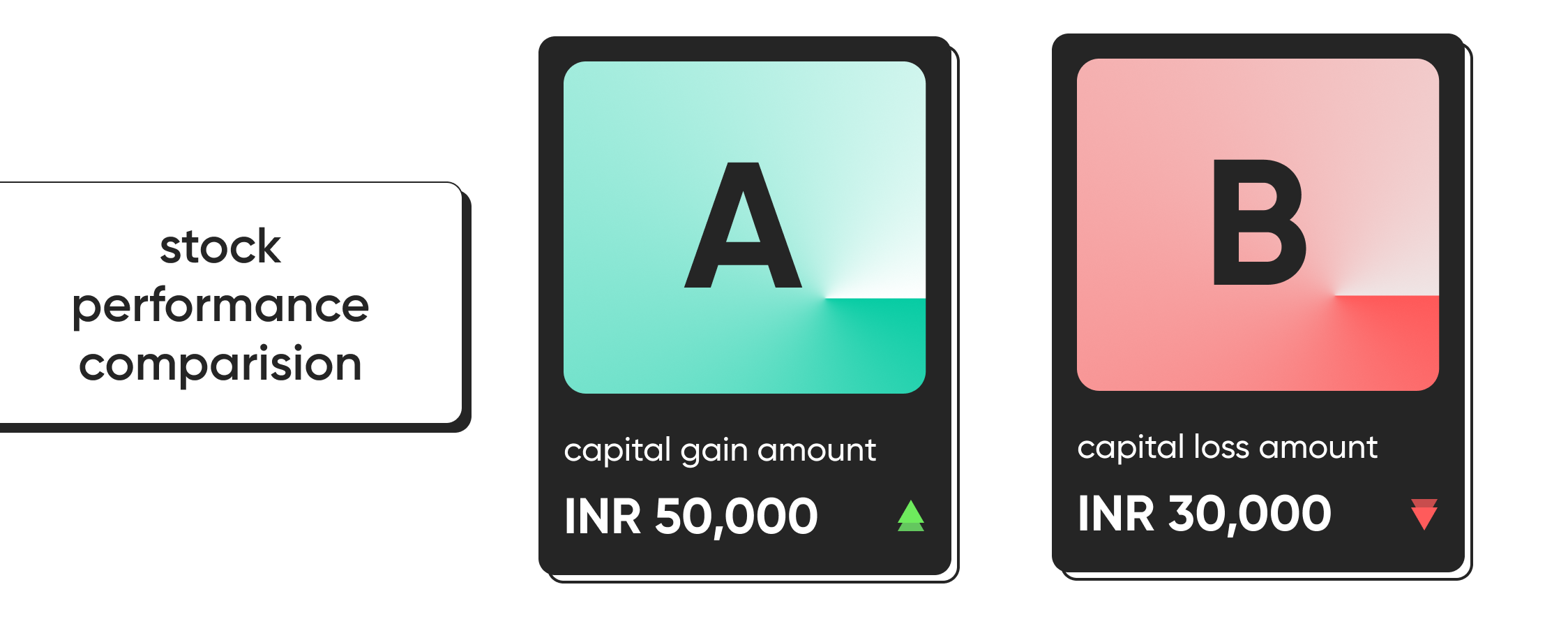

Let's consider an investor named Ravi who has invested in two different stocks in India: Stock A and Stock B. After holding these stocks for some time, Ravi realises that Stock A has performed exceptionally well and has generated a significant capital gain of INR 50,000. On the other hand, Stock B has experienced a decline in value, resulting in a capital loss of INR 30,000.

Tax Harvesting Process

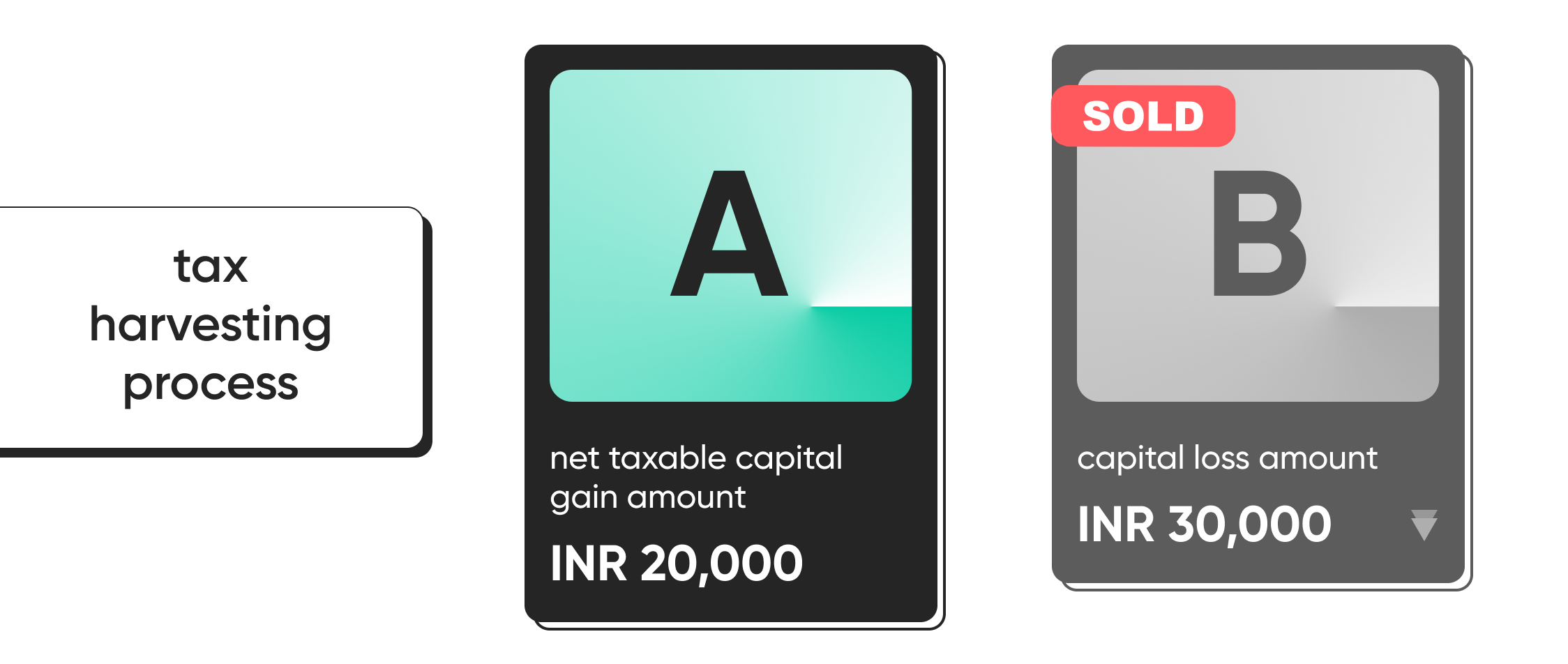

Offset Capital Gains with Capital Losses

Ravi decides to implement tax harvesting to reduce his tax liability. He sells Stock B, which has incurred a capital loss of INR 30,000. By doing so, Ravi can offset this loss against the capital gains from Stock A, reducing his overall taxable income.

Capital Gains Tax Calculation

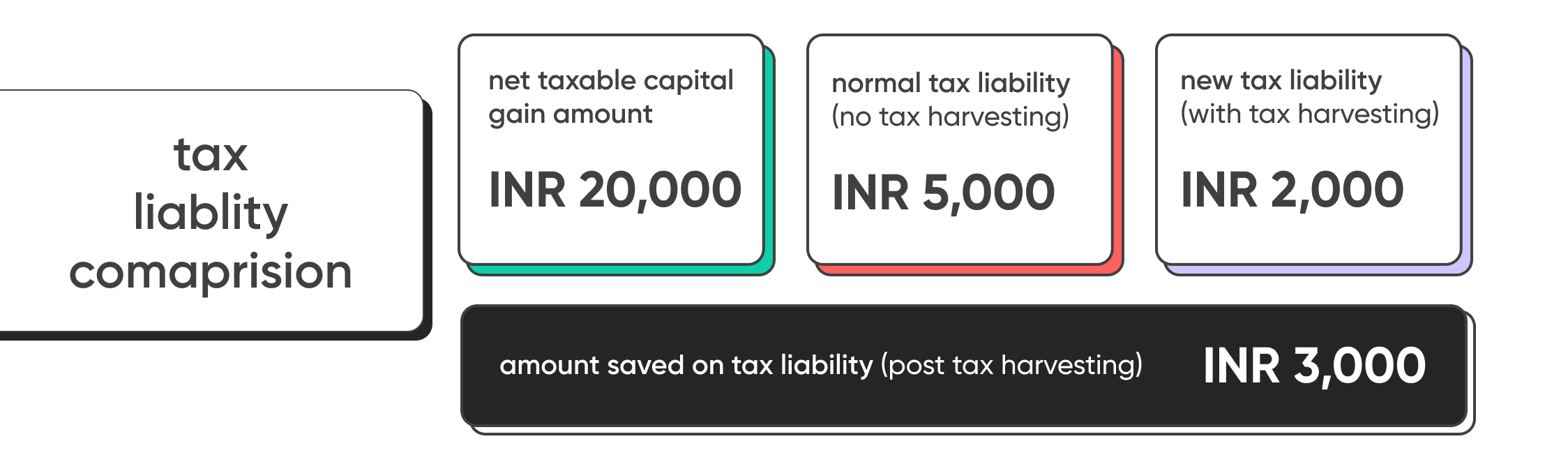

Assuming the applicable long-term capital gains tax rate in Ravi's case is 10%, his initial tax liability on the capital gain from Stock A would have been INR 5,000 (10% of INR 50,000). However, by utilising the capital loss from Stock B, Ravi can reduce his taxable capital gains to INR 20,000 (INR 50,000 - INR 30,000).

Revised Tax Liability

With the revised taxable capital gains of INR 20,000, Ravi's new tax liability would amount to INR 2,000 (10% of INR 20,000). By implementing tax harvesting, Ravi has effectively reduced his tax liability by INR 3,000 (INR 5,000 - INR 2,000), saving him a significant amount of money.

Conclusion

Tax harvesting is a valuable strategy that allows investors to optimise their investments and minimise tax obligations. By strategically selling investments with capital losses to offset capital gains, individuals like Ravi can reduce their tax liability and retain more of their hard-earned money.

It's important to note that tax harvesting involves compliance with tax laws and regulations. Seeking guidance from a certified financial advisor or tax professional is recommended to ensure proper implementation and maximise the benefits of tax harvesting. By integrating tax harvesting into your investment strategy, you can enhance tax efficiency and potentially enhance your overall investment returns.