Given the number of schemes and mutual fund options available today, it can get confusing to pick the best mutual fund to invest in.

Don’t worry though, Stack’s got your back! As a goal-based investing app, we’ll help you categorise and systematically consider all the mutual fund investing options available to you, through this quick read.

STEP 1- Determine your financial goals

Before beginning your mutual funds investing journey, you will have to set and define your financial goals.

You can use the S.M.A.R.T technique i.e. classify your long-term goals in a Specific, Measurable, Adjustable, Realistic, and Time-bound way to realistically identify your long-term goals. Read more about it here.

Setting up financial goals in this S.M.A.R.T way, helps give your investing journey a defined and constructive purpose.

STEP 2- Determine your risk profile

Like all investing, investing in mutual funds should also be in-line with your unique risk appetite. To get a clearer understanding of which risk profile you may belong to on Stack, you can read here.

Your risk level is measured on the basis of many different factors such as your age, prior experience with investing, investment horizon, and investment objective.

Understanding your risk profile is important because it helps you consider how suitable a particular mutual fund option is for you and your financial goals.

STEP 3- Consider your investment portfolio and time-horizon

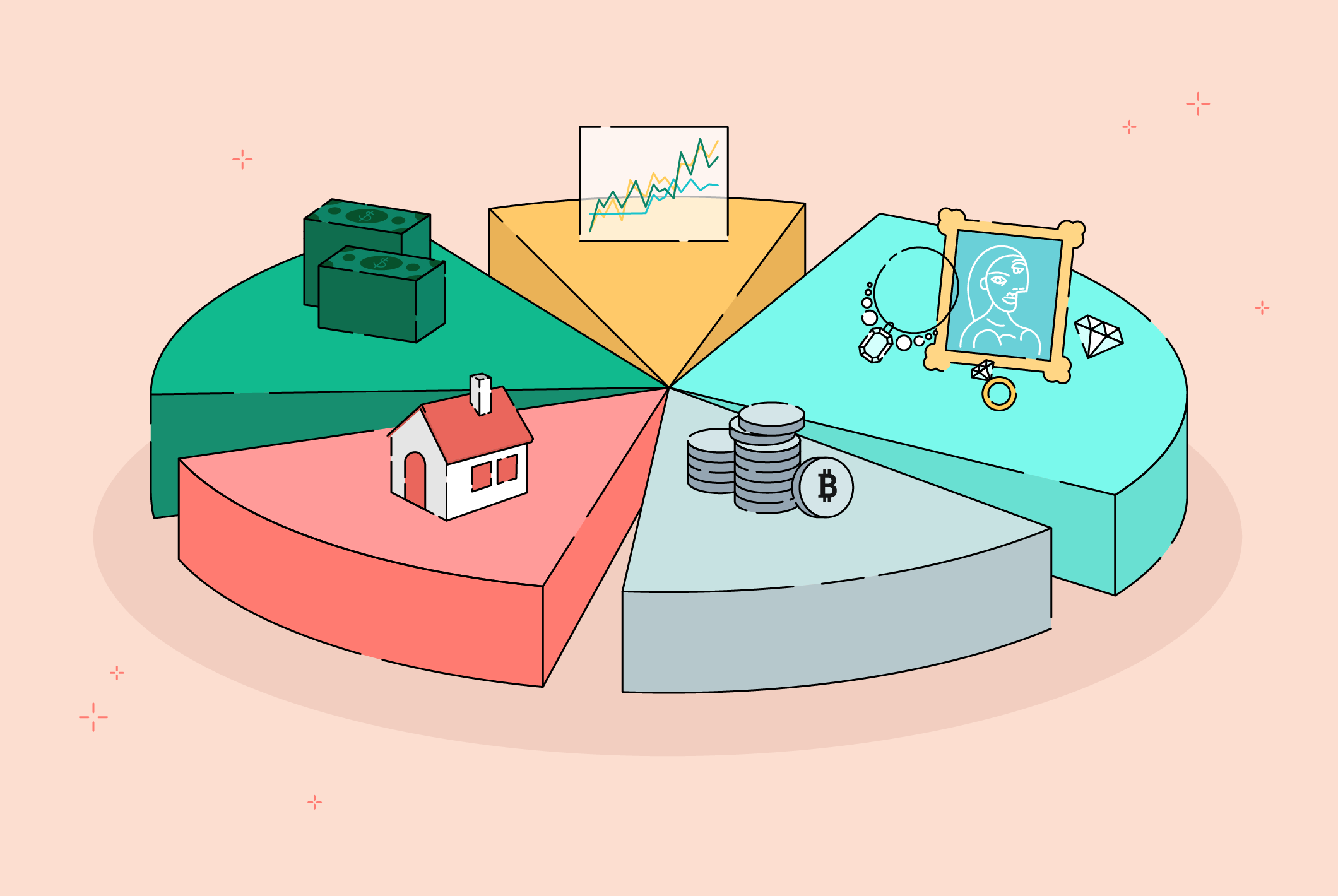

Your mutual fund investments should be a part of your larger investment portfolio, especially one that has varied asset allocations serving your different life and financial goals.

For eg, if your larger portfolio doesn’t include many tax-saving options you could consider ELSS, PPF, or NPS mutual funds to rectify it. Similarly, if your portfolio is equity heavy as against your risk profile, then you could consider offsetting your risk by investing in non-market related asset classes such as gold bonds etc.

Proper allocation, allows you to balance your portfolio’s risk and returns in-keeping with your financial goals, and investment time horizon.

Your time horizon is also a key factor in deciding your mutual fund investment strategy. Based on how long your investment period and your risk profile is, your mutual fund selection will either tilt towards equity or debt.

Considering your investment period, will help you steer your investment strategy towards your financial goals.

STEP 4- Consider some important metrics

When you arrive at some mutual fund categories based on the determining factors mentioned above, it's now time to consider some important metrics:-

1. Comparison- A fund's performance is usually determined when it's compared to another fund or a benchmark index for reference.

2. Past performance: It is important to evaluate the long-term and short-term returns of a fund, and its performance across different marketing cycles.

3. Risk-adjusted return: As a practice, most analysts use the Sharpe Ratio to measure risk-adjusted returns. It signifies how much return a fund has delivered vis-à-vis the risk taken.

4. Portfolio Concentration: A fund’s portfolio concentration is an analysis of its holdings. It is important to determine if the fund is not overexposed to particular stocks or sectors

5. Portfolio Turnover: The portfolio turnover rate refers to the frequency with which stocks are bought and sold in a fund's portfolio. Higher the turnover rate, the higher the volatility.

Consider key metrics like benchmark index, peer comparison, past performances, risk-adjusted returns, portfolio concentration and portfolio turnover in choosing the right mutual fund.

STEP 5- Consider the fund manager and the fund’s costs

Mutual funds are generally managed by a fund manager and their team. Therefore, it becomes integral that the fund manager is qualified and exceptionally skilled and comes with considerable experience in dealing with market volatility.

The expense ratio is the commission the fund manager charges for the proper management of the fund. It’s important to seek a mutual fund that comes with a lower expense ratio so that it doesn’t cut into your overall returns in the long run.

Considering the fund manager’s expertise and expense ratio is useful in determining the overall feasibility and impact of a mutual fund.

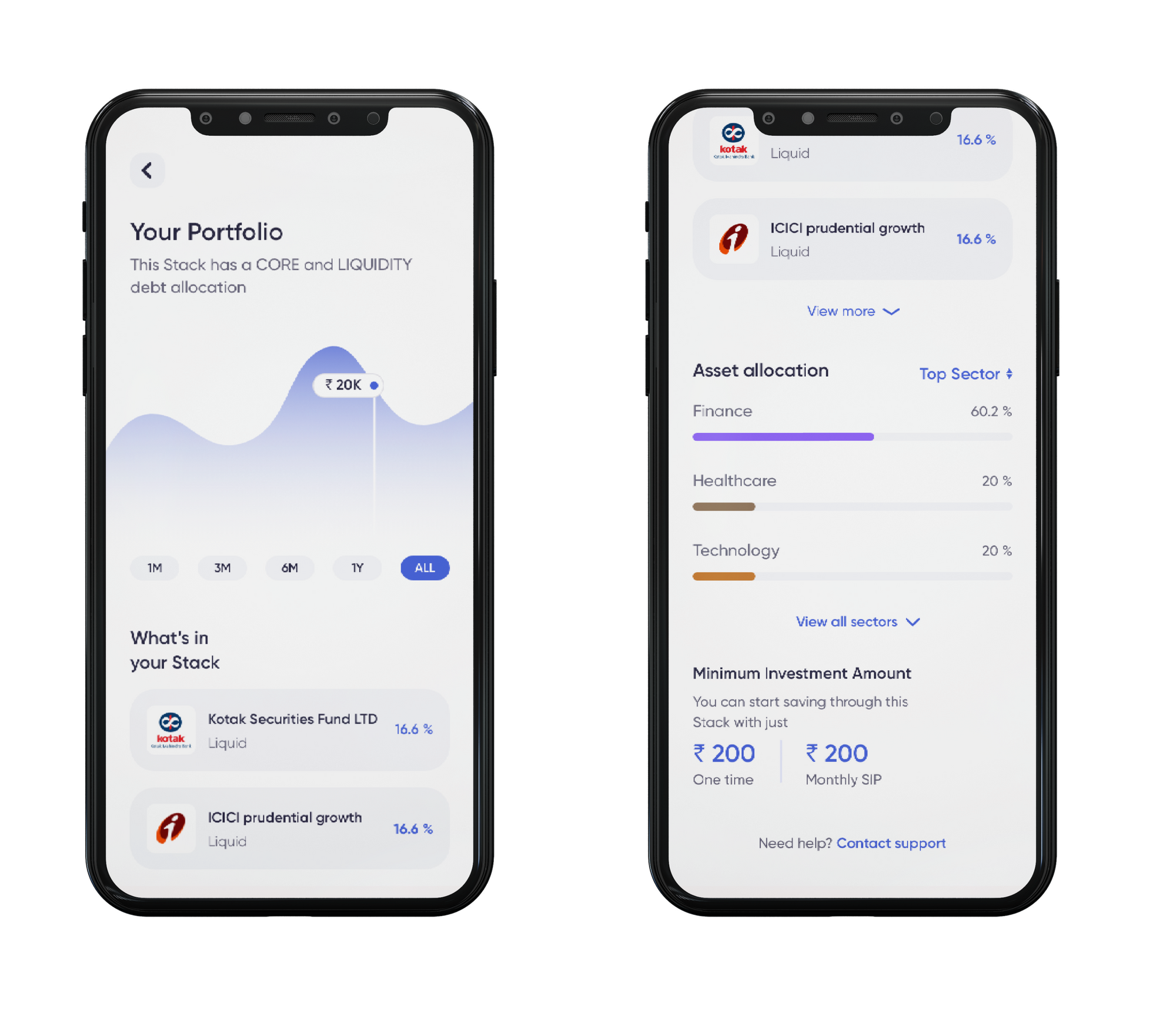

If all this still sounds extremely confusing and complicated, that’s because it is! If you are looking for an effortless way to invest towards your future financial goals through mutual funds, then consider Stack. We build expert-advised portfolios customized to your goals, risk appetite, and overall investing objective so that you don’t have to do the hard work!