Investing can be an exciting way to grow your wealth and achieve your financial goals. However, before you jump into investing, it is integral that you assess what your risk profile exactly is. Your risk profile is important because it determines what your investment strategy should look like and how your assets are allocated within a portfolio.

Quick Summary

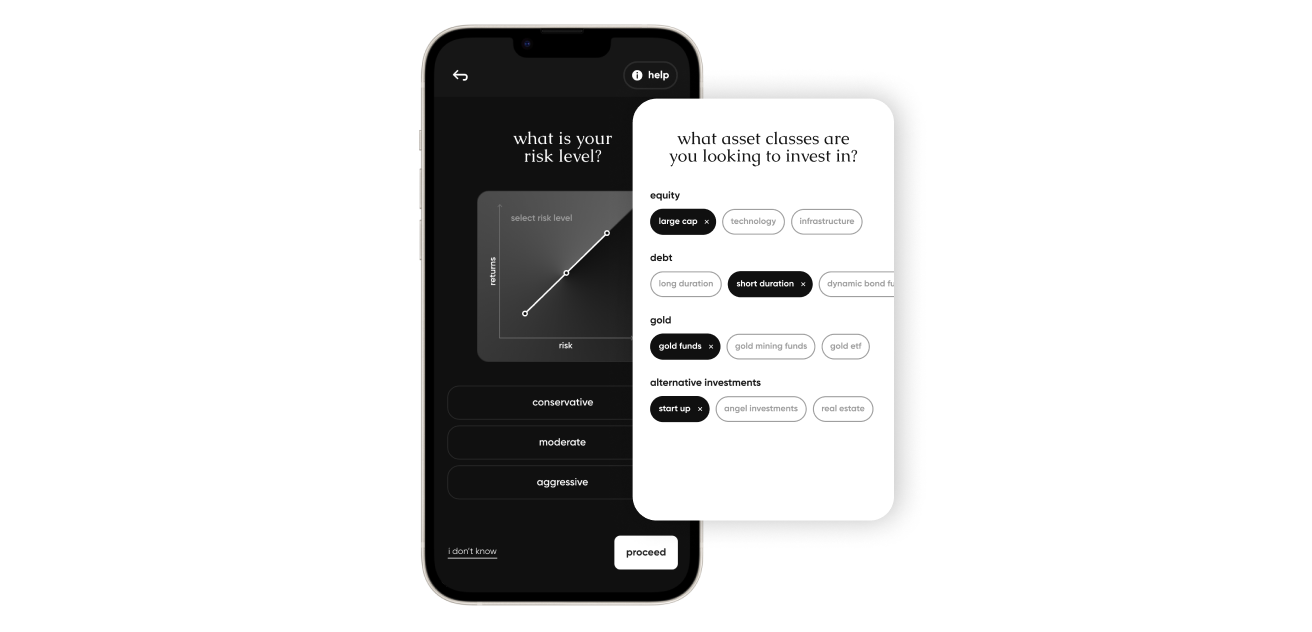

Assessing your risk profile is a critical step in building an effective investment strategy. Understanding your risk tolerance, by engaging in the coffee chat, can help you make informed decisions about asset allocation and investment vehicles that are best suited to your goals and financial situation.

Every investor is unique, and that’s why the same portfolio doesn’t work for everyone. This is where stack comes in. We’d like to get to know you individually to curate the right mix of assets that will help you crush your goals!

You can have this coffee chat again at any time. We understand personal situations and lifestyles may change over time, so we encourage users to do this every 12 months. This helps us make necessary adjustments to your long-term investment commitments.

One of the best and safest ways to control risk is through asset allocation. Asset allocation simply put, refers to how much money you are investing in different investment vehicles such as stocks, bonds, fixed income, debt funds etc. Generally, market-dependent asset classes such as equities and certain mutual funds are higher in risk while fixed-income securities and bonds offer stable (although lower) returns.

Want to know more? Talk to our advisory team. They will be happy to help you invest in your future!

Talk to an expertHow does the Coffee Chat work?

Let’s dive deeper into each question you’re asked during the Coffee Chat and why.

- Do you have loved ones who depend on you financially?

When you have financial dependents, it is ideal to take on lesser risk in the long term. This question helps us assess your equity allocation in your portfolio

- Okay, so are you a nerd about finance?

Assessing your pre-existing financial knowledge will tell us how we can make your investing experience better. If you’re someone who has little to no knowledge about investing, we’d recommend more traditional assets for your portfolio to begin with. Once you’ve built a good investment corpus, we’ll start recommending alternative investments that provide high returns but with high risk.

- How long do you wish to invest?

A time horizon is essential before investing. As a basic thumb rule, a longer term of investment allows you to include a higher equity allocation. A basic thumb rule for retirement tells us that

Percentage of equity in your portfolio = 100 - Your Age

This means if you’re young and are investing to retire, you can have a significantly higher equity allocation compared to someone who is planning to retire in 10 years.

- Do any of these asset classes interest you?

Even though our experts are doing the heavy lifting for you, we keep your interests in mind. Let’s say you’re interested in investing in Small Cap Funds. Small Cap Funds have higher volatility than most funds, and if you’re investing for only for the short term, we wouldn’t recommend it for your portfolio. But if you’ve built a good investment corpus and have room for some volatility, we’ll recommend the right portfolio that invests in small-cap funds at the time. Similarly, our experts are prepared to help you invest in the right kind of asset at the right time, especially if you’ve got your eye on that asset for a while.

Stack offers three risk profiles for investors, namely

- The Aggressive Profile

- The Balanced Profile

- The Conservative Profile.

The Aggressive Profile

The Aggressive Profile is ideal for investors who are primarily focused on pursuing above-average portfolio appreciation over time, and are willing to undertake a high level of risk. This profile serves the intent of maximising growth and building wealth. While we expect this portfolio to have the highest returns, it also carries with it the highest volatility. This profile is suitable for experienced investors who can withstand seeing large fluctuations in their account, with relative ease, and who wish to build a portfolio that has exposure to various asset classes but which is heavily invested in equities.

The Balanced Profile

The Balanced Profile is ideal for investors who strive to strike a balance between risk and returns, or value higher returns scaled to an agreeable amount of risk. This profile is suitable for individuals whose investment objective is a combination of growth as well as protection of their capital. While you do not expect the highest expected returns there are to offer, people who fall under this profile certainly enjoy a much-needed safety net during a market decline.

With the Balanced profile, there is still a moderate level of risk being undertaken. This profile is suitable for new investors who are apprehensive of large amounts of risk but still want significant returns in the long run, or for individuals who have accumulated a considerable corpus of money and wish to further grow it to build wealth.

The Conservative Profile

The Conservative Profile is ideal for investors whose investment strategy hinges on taking the most minimal amount of risk. This profile is suitable for individuals who have possibly accumulated a significantly sizable corpus of wealth and wish to limit fluctuations and park it while still trying to generate returns that beat the rate of inflation.

It could also be ideal for individuals who are extremely sensitive to risk and rely on their investments as a primary or passive source of income. This profile is suitable for individuals who are only comfortable with small fluctuations and wish to build a portfolio that is primarily focused on portfolio stability and preservation of capital.

About Stack

We help you invest like the top 1%. Stack lets you access exclusive wealth creation opportunities by helping you invest in premium multi-asset portfolios managed by real experts.

Learn moreRisk Assessment is Essential Before Investing

It’s important to assess your risk profile periodically since this may shift during your lifetime depending on changes in your life situation. Your risk profile may change over time, depending on changes in your life cycle. Maybe your income changed or you have new goals, etc.

Therefore, it’s important to reassess your risk profile periodically to ensure that your investments are in line with your current financial goals and risk tolerance. Stack helps you achieve this by providing an investment platform that aligns with your risk profile and financial goals.

Conclusion

So, to conclude, assessing your risk profile is a critical step in building an effective investment strategy. Understanding your risk tolerance can help you make informed decisions about asset allocation and investment vehicles that are best suited to your goals and financial situation.

Remember that your risk profile may change over time, and it's essential to reassess it periodically to ensure that your investment strategy aligns with your current financial situation, goals, and risk tolerance.

If you haven’t had the Coffee Chat with Stack yet - this is the sign to do so right away! In just 5 minutes, we’ll give you a detailed report that will show you what kind of investing style suits your financial goals. All you have to do is -

- Download & install the Stack app from the App Store or Play Store

- Complete the signup process in just 2 minutes.

- Once this is done, you will be automatically prompted for the “Coffee Chat”

- If you have already started investing, just select the Flagship Stack to have the Coffee Chat with us.

With this information, you can build a diversified portfolio that meets your financial goals while managing risk effectively. Remember, a well-diversified portfolio with an appropriate asset allocation can help you achieve your financial goals while minimising risk.