Last week in a nutshell

📈 The most-awaited IPO, Tata Tech, was oversubbed by ~70x.

🙌 Sam Altman returns to OpenAI, sacks the board that fired him.

😳 Raymond’s MD’s wife demands 75% as divorce settlement, could impact stock price.

🌍 China's world GDP share faces the largest decline since the ‘60s

🛵 Ola Electric converts to public company ahead of IPO filing

The big story: The record-breaking IPO of 2023

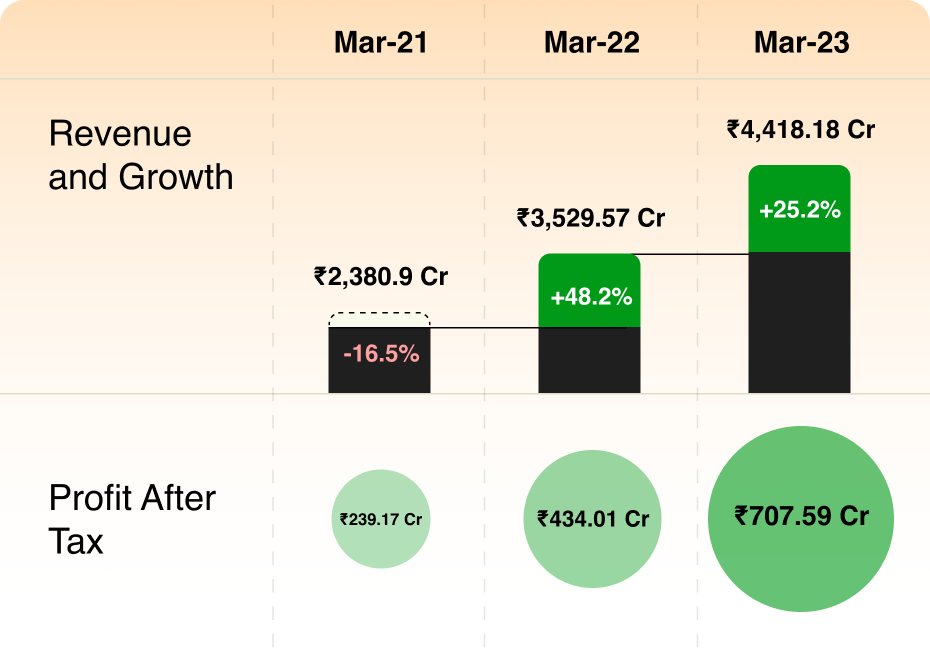

In the humdrum world of engineering and product development, Tata Technologies stands out like a beacon. The three-day IPO, the first IPO from the Tata Group in two decades, closed on Friday with an overall subscription of 69.43 times with bids worth ₹1.56 lakh crore for an issue size of ₹2,200 crore. There’s no doubt that the company is a cash cow, here’s why.

Tata Technologies' portion for retail investors saw 16.5 times subscription so far, while those reserved for shareholders of Tata Motors were subscribed over 29.19 times. This was purely an Offer for Sale (OFS), which means that the company will not receive any proceeds from the IPO.

However, Tata Technologies is a cash-generating company and had cash worth $150 million on its books at the end of the financial year 2023.

Our expert opinion: While Tata Tech is valued at 20,000 cr, just 3½ years ago, its parent company, Tata Motors itself, was valued at just 26,000 crores in market cap.

Interestingly, peers like KPIT Tech and Tata LXC are trading at valuations of 80x earnings and 60x earnings, respectively. However, Tata Tech is at a valuation of roughly 28x to 30x, which is reasonable.