🛵 Will ONDC thwart Swiggy & Zomato’s dominance?

🏭 Adani's flagship doubles quarterly net profit while Wilmar takes a hit

🏦 SEBI considers performance-based fees for MFs

Read Time: 3 mins

ONDC v/s Swiggy & Zomato

Magicpin fulfilling 10,000 Orders Per Day on ONDC Platform

India's hyperlocal startup, magicpin, announced that it is fulfilling over 10,000 orders per day on the Open Network for Digital Commerce (ONDC) network, up from 1,000 orders two weeks ago. The company is fulfilling these orders through its own seller portal as well as other start-ups like PhonePe's Pincode, Spice Money, Mystore, Craftsvilla, Meesho, and Paytm. The hyperlocal startup had recently onboarded nearly 25,000 food merchants from its network of local restaurants, making it the largest restaurant aggregator on ONDC.

Zomato and Swiggy accused of charging high commissions

ONDC, launched in April 2022, aims to end the duopoly of Swiggy and Zomato in India's $50bn food services market. Amazon and Ola had previously failed to challenge the dominance of Swiggy and Zomato. ONDC could solve the challenges that the food aggregator platforms pose to restaurants, such as increasing commissions and flawed rating mechanisms.

Our Opinion: Disruption is the name of the game! While Swiggy is the market leader in South India, Zomato rules the North in the food delivery space. This duopoly structure is now clearly under threat because the ONDC platform, which shares valuable customer data with service providers has been precisely built as an initiative of the Government of India to foster healthy competition in the market and provide a level playing field to small merchants and end the dominance of a few players.

2. Adani Group’s Emotional Rollercoaster

Adani Enterprises reports doubled quarterly net profit

Adani Enterprises Ltd reported a more than 2x quarterly net profit of ₹780.68 Cr from ₹325.76 Cr in the previous year, and a consolidated net profit for the full fiscal year of ₹2,421 Cr, which was up more than 3 times from ₹787.7 Cr in the previous fiscal year. However, the full-year profit missed analysts' estimates of ₹4,201 Cr by a wide margin.

Adani Wilmar Q4 net dips 28%

Adani Wilmar's Q4 consolidated net profit dropped 60% to INR 93.61 crore YoY due to low edible oil prices, while revenue fell 7% to INR 13,872.6 crore. The company's FY23 consolidated profit also fell 28% YoY to INR 582.12 crore despite a 7.4% increase in revenue to INR 58,184.8 crore.

Our Opinion: While the quarterly results may continue to provide short term knee jerk reactions in the Adani group stocks, the bigger elephant in the room continues to be the ongoing investigations by SEBI which has incidentally sought a 6-month extension from the Supreme Court to complete its ongoing investigation into the group’s activities as alleged in the Hindenburg report.

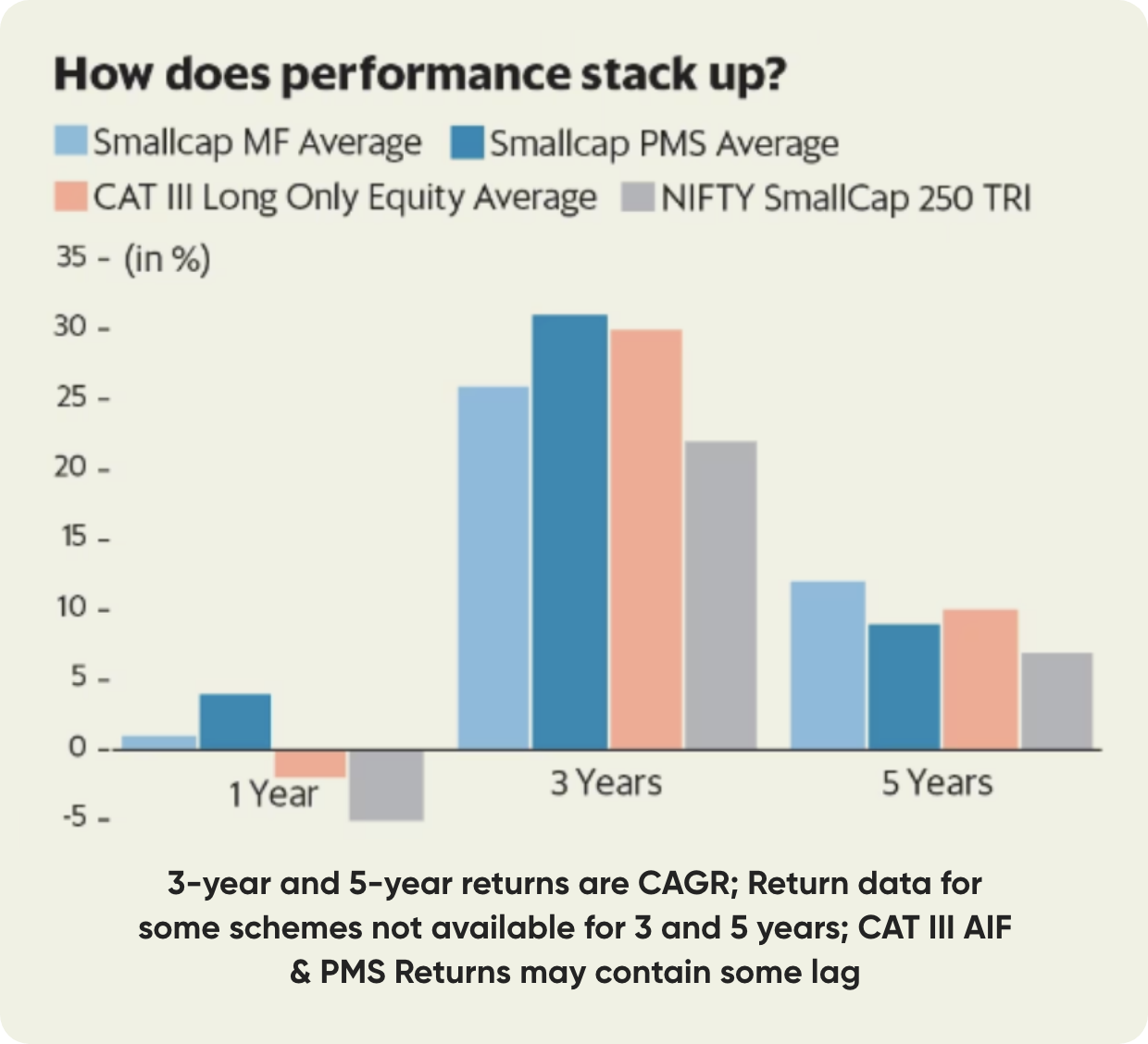

3. Performance-Based MF Fees

SEBI's game-changing move to revolutionise mutual funds

SEBI is considering a new mutual fund (MF) category that would link fees to portfolio performance. Media reports suggest that SEBI may allow fees to be tied to benchmark performance, rather than charging a fixed rate based on total assets. This would make India one of the few markets with such a fee structure. Currently, 88% of actively managed Indian funds underperformed the S&P BSE 100 in 2020. The new category could improve the industry’s transparency and investor outcomes.

Will Investors Benefit or Risk Losing Out

Globally, some MFs in the US and UK charge performance or incentive fees based on their returns relative to a benchmark, while most MFs charge a fixed percentage as fees. There are three potential fee structures in India: the current arrangement, a reduced base fee with a standard performance fee, and a high base fee with fulcrum performance fees. While symmetric fees are preferred, it is uncertain whether India will adopt this structure, and some experts recommend introducing alternative fee structures gradually.

Our Opinion: Warren Buffet famously quoted in a shareholder letter “Performance comes and goes but fees never falter”. So while this move is encouraging as there would be a clear alignment of interest between fund managers and investors there are genuine concerns such as possibility of increased risk taking undertaken by Fund Managers or creation of easy to beat benchmarks in order to justify charging higher fees from clients versus the current structures prevailing in the market.