🍽️ Is Zomato dishing out more than expected?

🚀 India's nuclear dreams going private

📈 India beats China as per Morgan Stanley Report

Read Time: 3 mins

1. Zomato Serves Up

Zomato Shares Rise 12% on First Quarterly Profit

Zomato's stock surged 12% after it posted a debut quarterly profit. Starting at ₹89 and peaking at ₹98.39, Q1 FY24 earnings showed ₹2 crore profit compared to ₹186 crore YoY loss, with revenue at ₹2,416 crore.

Zomato's Profitable Q1 FY24 Boosts Market Confidence

Zomato's Q1 FY24 net profit of ₹2 crore marked a shift from a ₹186 crore YoY loss. Foreseeing 40%+ revenue growth, Emkay raised the target price to ₹110, retaining a "BUY" stance.

Our Opinion: It is encouraging to see that newly listed tech platforms have been walking the talk on moving towards a sustainable path to profitability. The Stock markets have already rewarded shareholders of such companies in recent months which goes to prove that public markets behave very differently when it comes to financial performance of listed companies as opposed to evaluation criterias for private companies by professional investors such as VCs/PEs

2. Privatising Nuclear Power?

India Explores Private Role in Nuclear Power for Decarbonization

India considers changes to its atomic energy law, potentially allowing private firms to develop small modular reactors (SMRs) for emissions reduction. SMRs align with the goal of 50% clean power generation by 2030.

India Aims to Expand Nuclear Capacity

State-run NTPC prioritizes adaptable SMRs for quicker construction. India targets 22.5 GW nuclear capacity by 2031, exploring private involvement to advance SMR technology for its clean energy ambitions.

Our Opinion: Recent advancements in nuclear energy technology, particularly the development of SMRs will be critical for India’s clean energy goals. Implementation of SMRs could dramatically transform India’s nuclear power industry especially given India’s vast geographical area and the lack of infrastructure in many regions to support larger reactors.

3. “India beats China” - Morgan Stanley

Morgan Stanley Upgrades Indian Markets Due to Favorable Factors

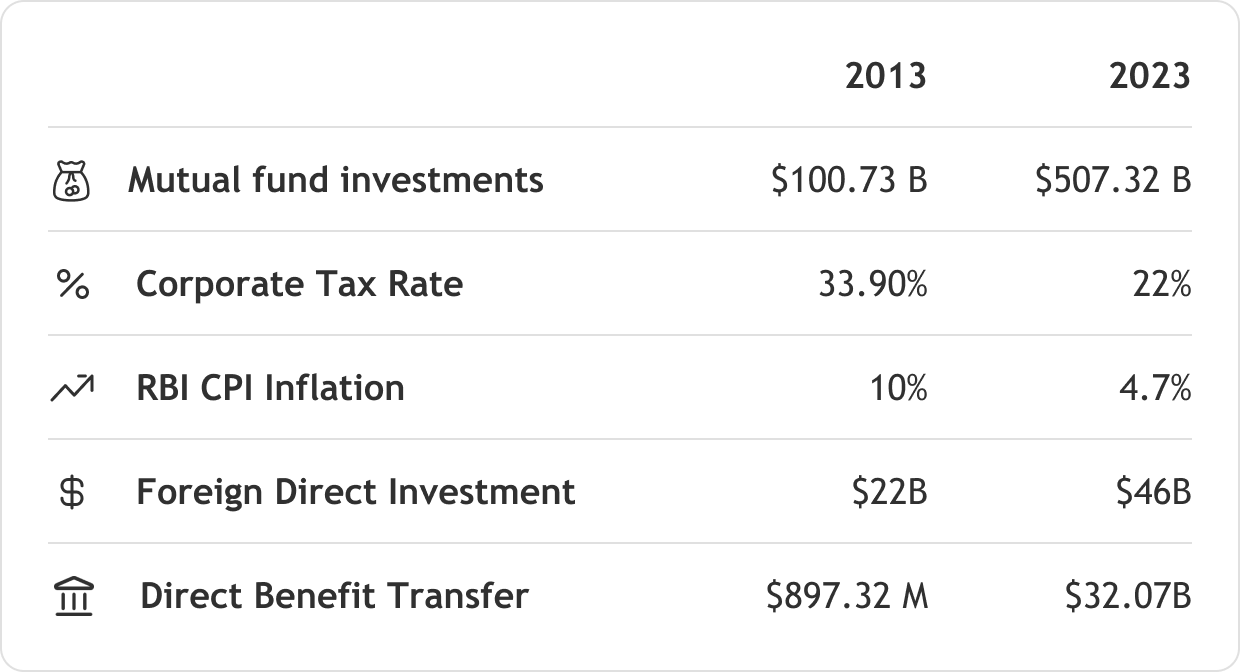

Morgan Stanley, which had put India in the ‘Fragile Five’ during the UPA era, upgraded India’s rating to overweight and downgraded China to equal-weight, citing improved valuations compared to October 2022. India now ranks as the most-preferred emerging market, driven by foreign inflows, macro stability, positive earnings outlook, and sustained EPS growth.

India's Market Strength Contrasts with China's

In a shift, Morgan Stanley elevates India's position while downgrading China to "equal weight." India's bullish market, supported by demographic factors and sectoral strengths, stands in contrast to China's potential downturn, marking a structural shift in India's favor.

Our Opinion: With the economy firing on all cylinders, stable macros and healthy corporate balance sheets, India is arguably at the start of a long term boom similar to where China once stood in the early 2000s. With significant headroom to grow in possibly every category on per capita metrics, coupled with the smart long term moves that India has been making on the Geopolitical as well as the domestic front, there couldn’t be a more perfect time for International Investors to turn overweight on our Country.