Investing is a precise and intricate game, we advise you to NOT look up ‘Best mutual funds to invest in 2022’ for quick and easy results, because more often than not these recommendations are biased and sponsored by parties who gain to succeed from preying on naive and beginner investors alike.

That being said, we understand that picking the right mutual fund is often a time-consuming and comprehensive process, which involves being acutely aware of your overall investment objectives, risk profile, tenure period etc. If we’ve convinced the merit of this method then check out our blog here.

If, however, you’re still looking for some easy and unbiased suggestions on the top mutual funds to invest in 2022, then here’s what we’ve found.

We’d like to first preface this by saying that we identified a couple of categories across equity, hybrid and debt such as - large cap equities, mid cap equities, small cap equities, bonds, liquid funds, ultra-short term funds etc . We selected these categories considering the experience and risk appetite of regular retail investors, ranging from novice first-time mutual fund investors, to experienced ones and with conservative, balanced on aggressive risk appetites respectively.

We’ve also considered funds based on a few key metrics- such as their track record over different market periods, their risk-adjusted returns, credit-rating, exit load and expense ratios etc.

Conservative

If you are new to mutual fund investing, or to investing in general, Hybrid Conservative, Large Cap Index Funds, ultra short term and liquid funds are the best for you. In Hybrid funds to avoid the hassle of rebalancing, Index Funds for low cost and passive investment strategy.

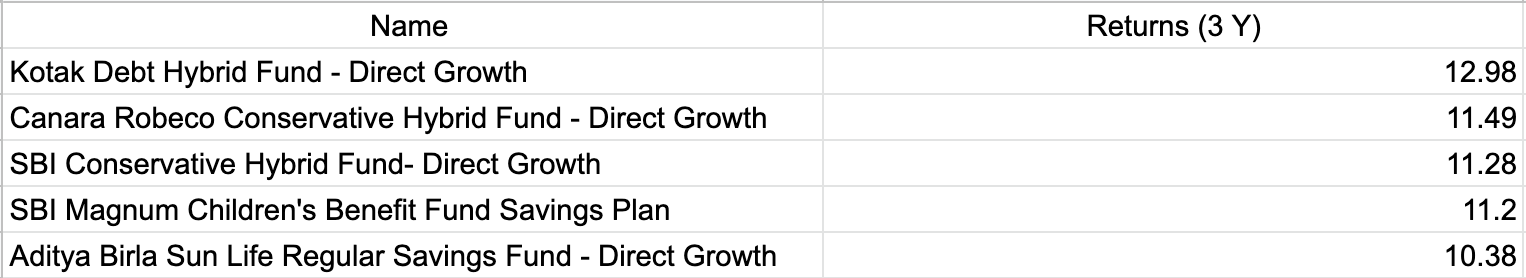

The top Conservative Hybrid Funds

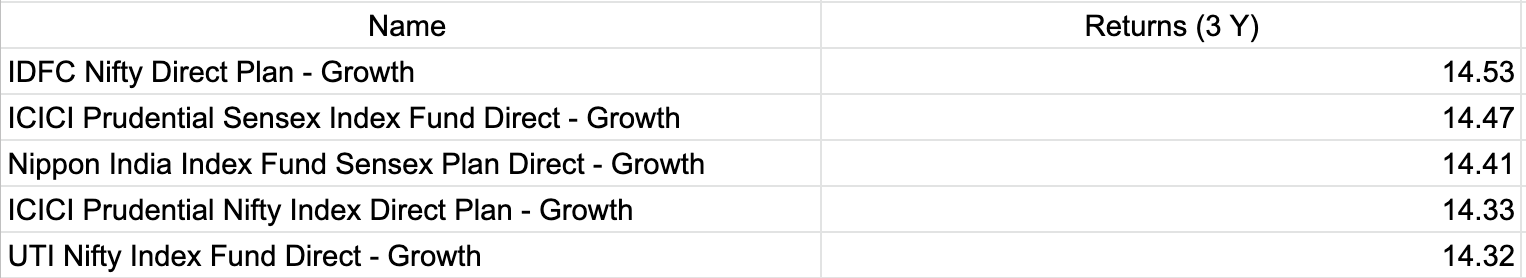

The top Index Funds

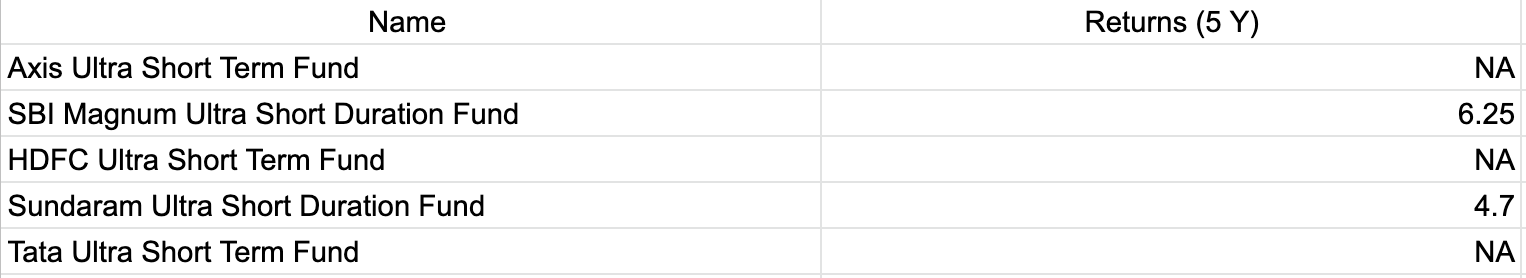

The top Ultra-Short term Funds

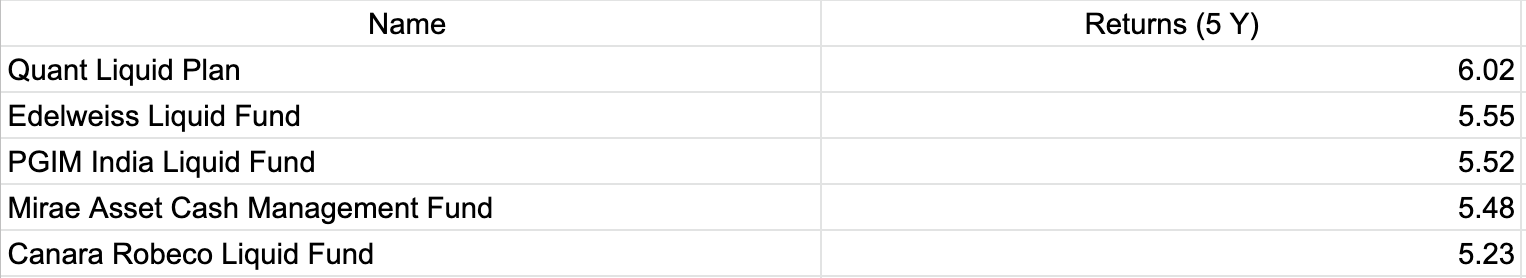

The top Liquid Funds

We suggest that you choose an investing style that keeps pace with you gradually, start out with a monthly SIP of a small amount in any of these funds instead of a large lump sum investment and then as you get comfortable consider increasing your SIP amount.

Some of the top Funds for SIPs are:

Balanced

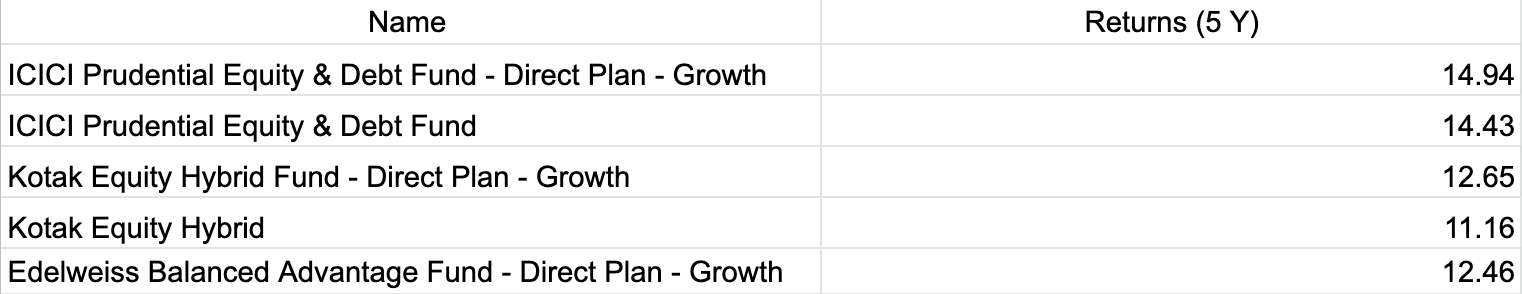

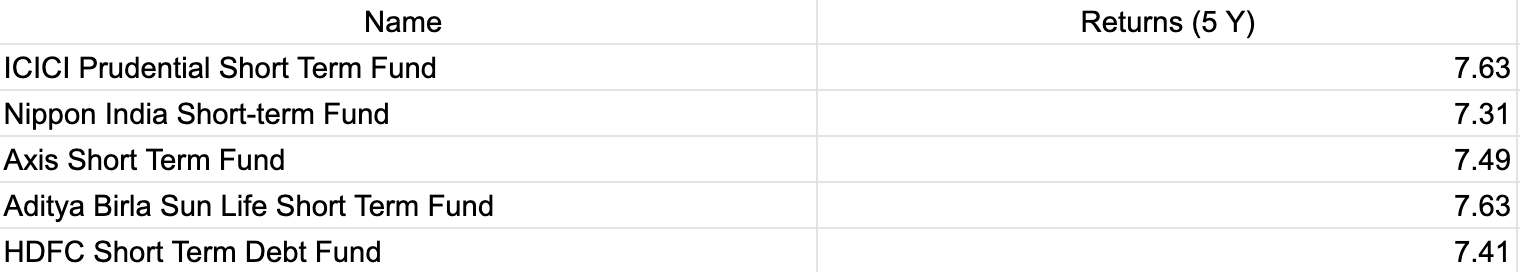

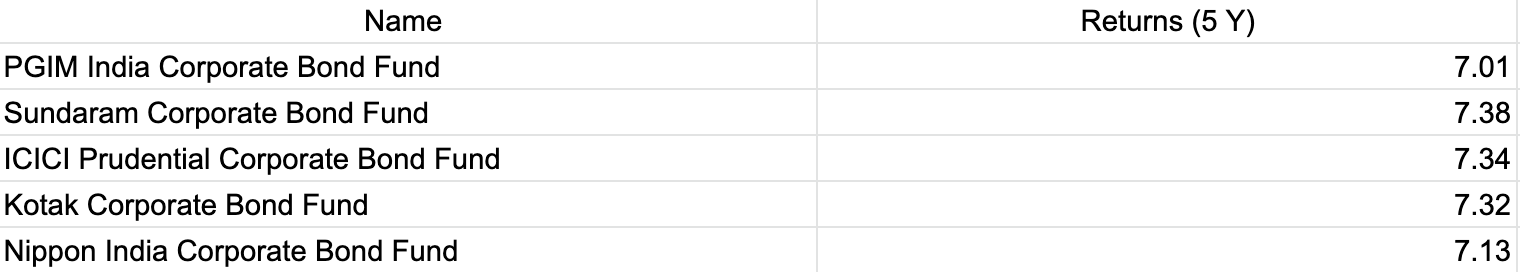

If you expect higher returns but don’t want to take on the risk of completely investing in equity, then consider these hybrid funds that offer a balance of debt and equity. For only equity allocation, index funds are generally a balanced option. You can also consider short-term and corporate bond funds to offset your portfolio's risk.

Top Balanced Hybrid Funds

Do keep in mind though that higher returns do come with a higher amount of risk, and your money can see some level of volatility if you choose any of these funds.

Top Short-term Funds

Top Corporate Bond Funds

Aggressive

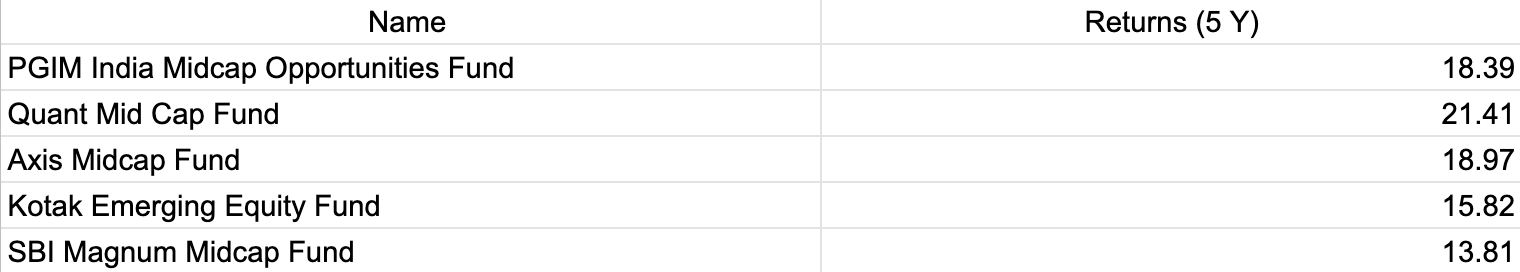

We strongly recommend that you first test out the waters with a lower risk level if you are a complete beginner to investing. If you are a seasoned investor and have done your research, derived your own risk profile (link to risk level blog), and are seriously interested in investing for the long term, then combination Index funds for large cap category, Midcap fund and Small funds are just the pick for you.

Top Mid-Cap Funds

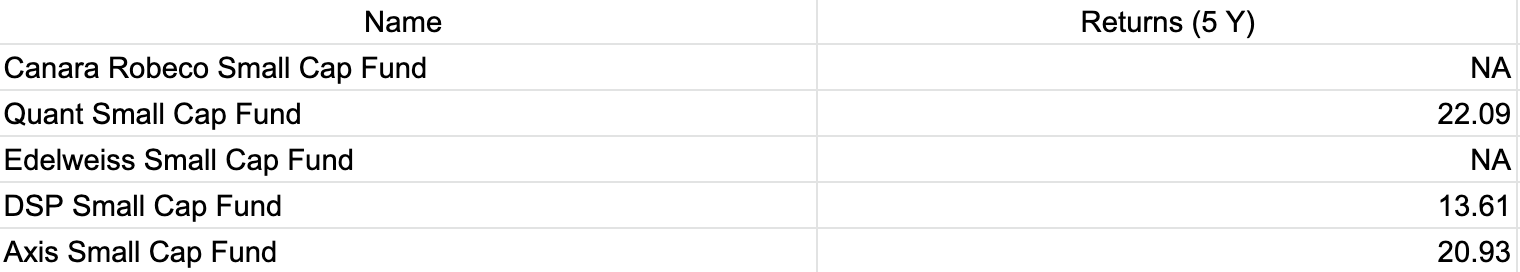

Top Small-Cap Funds

While Index Funds mirrors the Index and offers return in line with these Indices, Active Mid cap and Small cap funds have higher potential to offer high long-term returns. But they do come with a considerable amount of risk, which means that they are definitely ill-suited if your investment objective is for a short duration.

As mentioned earlier, any of the above funds you pick, must first align with your risk level and overall investing objectives and financial goals to truly be of any benefit for you. You would have to assess the mutual funds you select carefully first, but if that sounds like too much of a hassle there is always Stack.

We build globally diversified portfolios that are already customised to your goals and risk, and which include a diverse assortment of assets and funds, so that you never have to cherry-pick them manually.